The following is a guest editorial courtesy of Andrew Lane, CEO of sentiment-based technology company Acuity Trading.

We’re well into the back half of the year and oil prices remain below $100 per barrel. This seems like such an achievement, given that oil prices unprecedentedly hit negative territory in April last year. With demand hitting rock bottom, producers had no storage available and agreed to actually pay spot buyers to take crude. Following those dark days for the oil market, demand has significantly recovered. While spot prices traded at historical discounts to futures prices in 2020, the situation has flipped. The world’s economy needs oil again and needs it now.

Oil’s previous supercycle lasted for a decade, between 2004 and 2014, when a China-led commodity market boom pushed oil to over $100 per barrel. So, are we headed into an oil supercycle? Will suppliers again be struggling to keep up with soaring demand? Most importantly, will oil breach the key $100 market and spike to $200?

Drawing on Reserves: A Consumption Recovery Story

Demand is what fuels a supercycle. In the 2004-2014 period, Chinese industrialisation drove growth. In 2021, the narrative has changed to countries across the globe emerging from economic contraction – a butterfly shaking off the remnants of its cocoon, to soar. The small roadblock to this narrative is that the cocoon, aka covid-19, seems difficult to shaken off. On the contrary, the virus keeps coming back in mutated forms to pose new challenges and slowing down economic growth

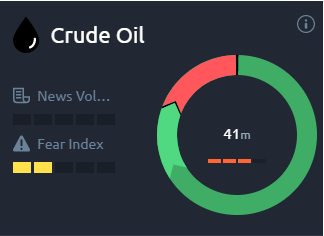

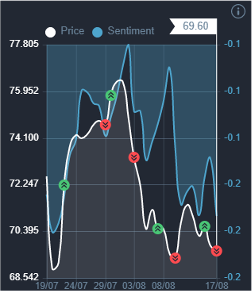

Although the Delta variant poses meaningful threat to the promising growth stories in Asia, including China, India, Korea, and Japan, the optimistic narrative holds. In July, the IMF released projections for global growth at 6% for 2021 and 4.9% for 2022, despite stuttering growth in key Asian countries. Drawdowns in oil inventories persisted throughout the first half of 2021 and, while the pace is expected to decelerate in the second half, experts expect the demand for oil to continue rising, supported by the current pace of vaccine rollouts and massive stimulus packages in advanced economies. Against this backdrop, the sentiment for oil remains positive, as can be seen in the Acuity Trading Dashboard.

Fill Her Up: A Case for Supply Shortages

OPEC+ and the US voluntarily cut oil supply through 2020. Some supply has returned since, but OPEC+ is unlikely to completely phase out production cuts before September 2022. While the EIA expects global production to outpace demand by 2022, this is highly unlikely.

For one, there has been no new investment in production since 2014. Also, the uncertainty over demand can prolong supply underinvestment.

All That Talk About Going Green

How much will rising environmental consciousness impact prices? The pandemic seems to have brought Going Green into everyone’s radar. The transition to green technologies is among the greatest threats to oil, as governments seem determined to phase out fossil fuel vehicles. The Biden administration has proposed a $174 billion investment in the EV market.

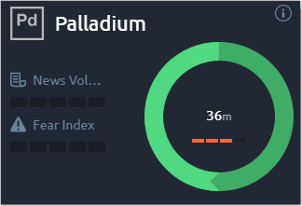

In the near term, however, this trend towards green could actually benefit oil. Even as EVs gain popularity, setting up their manufacturing facilities and charging stations will rely on existing oil-powered infrastructure, for everything from fabrication to logistics. Growth in EVs will, therefore, likely be a tailwind for oil prices in the short run. The ramping up of the EV market is driving a rally in the overall commodity market, including in metals like silver and palladium. The overly positive sentiment for these metals can be seen on the Acuity Trading Dashboard.

Much like the previous decade, China is determined to shape global economic growth in the years ahead. Much of its recovery strategy does not encompass green initiatives. And those that do, are being achieved on the back of its existing oil and coal-powered economy, increasing oil demand. Moreover, as China grows, so will its energy demand. So, even if the mix shifts, the absolute consumption of oil may remain the same or even grow in the near term.

The trend of green investing has led investors to shun oil stocks in favour of ESG assets. In 2020, ESG indices outperform their conventional counterparts. Similar trends can be seen in the Fixed Income space, with the green bond market surpassing $1 trillion in 2020. The impact on oil companies is twofold. First, it impacts their access to funding, threatening their ability to turn on supply, conduct explorations and invest in new projects. Secondly, many oil majors are state-owned and were forced to maintain a high dividend or share buyback policy even during the pandemic, reducing the cash flow available for reinvestment. Both these factors pose curtail their ability to ramp up supply.

Even in an accelerated green energy transition scenario, McKinsey estimates 23 million barrels of new production will be required to meet demand after 2030.

How likely are oil prices to hit $200 per barrel? Much depends on how quickly economies recover from the pandemic and how rapidly they transition to a green economy. The transition is likely to be stickier than policymakers expect, leading to a continued rise in oil consumption at east over the next couple of years.

Hayatımda ilk defa bu kadar seviyeli ve özenli bir hizmetle karşılaştım. Özellikle Ankara escort seçenekleri arasında AnkaraRusModel gibi bir site bulmak büyük şans.

Gizlilik, temizlik, iletişim… Her şey dört dörtlüktü. Özellikle Çankaya escort profilleri çok zarif ve dikkat çekiciydi.

Çankaya’da bir süredir aradığım kaliteli ve güvenilir deneyimi nihayet bu sitede buldum. Çankaya escort arayanlara kesinlikle tavsiye ediyorum.

Gizlilik, konfor ve kalite… Ankara Escort arayışlarımda tam anlamıyla ihtiyaçlarımı karşıladı.

Cihazlar kategorisinden alışveriş yaptım. Cihazlar ürünleri kaliteli, hızlı kargolu ve kullanışlı. Tavsiye ederim.

Medikal Teksil kategorisinden alışveriş yaptım. Medikal Teksil ürünleri kaliteli, hızlı kargolu ve kullanışlı. Tavsiye ederim.

Einen angenehmen Start in den Urlaubstag bietet entweder ein Frühstücksbuffet oder ein Frühstück im Zimmer.

Das Dekor in schwarz und beige schafft den perfekten Kontrast mit den immer

kurvigen Linien des Hotels und des Swimmingpools.

Der internationale Flughafen von Madeira befindet sich nur 20 km

entfernt. Im Tal Curral das Freiras zeigt sich das Landesinnere von Madeira mit seinen atemberaubenden Ausblicken auf die umliegenden Wälder

von seiner schönsten Seite.Dieses Hotel befindet sich nur fünf

Minuten zu Fuß vom Zentrum Funchals entfernt.

Lassen Sie sich in den vier Restaurants und Bars mit Panoramablick verwöhnen, spielen Sie

eine Partie auf dem Tennisplatz oder nutzen Sie den direkten Zugang zum Casino da Madeira, inklusive Spielzimmer,

Shows und Diskothek. Es befindet sich direkt am Kreuzfahrthafen in der Bucht von Funchal, nur fünf Minuten zu

Fuß vom Stadtzentrum und dem Mittelpunkt des gesellschaftlichen und kulturellen Lebens entfernt.Mit seiner

Lage direkt am Meer ist das Hotel eines der beliebtesten der Insel Madeira.

Der Infinity-Außenpool des Pestana Casino Park mit integriertem Kinderbecken lädt

zu einem erfrischenden Bad mit Panoramablick auf den Atlantik ein, während der beheizte Innenpool das ganze

Jahr über eine entspannte Atmosphäre bietet.

Die Unterbringung bietet Nichtraucher- und Raucherzimmer.

Das Badezimmer, ausgestattet mit einer Dusche und einer Badewanne,

verfügt über einen Haartrockner. Erfrischende Getränke an der Poolbar und wohlige

Entspannung im Whirlpool bringen alle Wasserratten in die beste Stimmung.

Zur weiteren Einrichtung des Apartmenthotels zählt ein Spielzimmer.

Während Ihres Aufenthalts können Sie eine Vielzahl von Magic SPA-Massagen und -Behandlungen sowie einen beheizten Innenpool mit Wasserdüsen genießen. Außerdem

sind rollstuhlgerechte Zimmer mit barrierefreiem Badezimmer buchbar.

Für besonderen Komfort in den Badezimmern sorgen Kosmetikartikel.

References:

https://online-spielhallen.de/1red-casino-bewertung-meine-10-jahre-erfahrung-auf-den-prufstand-gestellt/

While Australian-based companies are prohibited from offering online casino games to residents,

it’s not illegal for Australians to play at offshore online casinos.

Understanding the different types of online casino bonuses available

can help players make informed decisions and maximise their gaming experience.

Free spins are a favored promotion at online casinos, letting players spin the reels

of pokies without spending their own money. Among these, you

can play online casino games like online pokies, online blackjack, and live dealer games that are particularly popular in Australian casinos.

Australian online casinos offer a wide range of online casino games, categorized into slots,

table games, live dealer games, and specialty games.

Casino Buddies is Australia’s leading and most trusted online gambling comparison platform, providing guides, reviews and news since

2017. In Australia, the Interactive Gambling Act

2001 controls online gambling. The Australian government considers online gambling a recreational activity.

All the casinos available at Casino Buddies are vetted for these measures and much more besides.

But that does not mean there are no online destinations for Aussie gamers.

Sports betting, bingo games, lotteries and social games are all legal and

regulated. Make no mistake, you will find scores

of gambling sites with tremendous portfolios.

casino mit paypal einzahlung

References:

https://jobsrific.com/employer/best-paypal-friendly-poker-platforms-in-2025/

online casino that accepts paypal

References:

geokofola.geopivko.cz