If you’re in the forex business, you know it’s a global, decentralized OTC market with the highest liquidity. The forex market barely sleeps – it’s open 24/5, from Monday to Friday, across Australia, Asia, Europe and North America. But sometimes we can’t see the forest for the trees. We forget that the Forex market has a rich history, a diverse landscape and some fascinating facts. Today, Tradinglive will take you to find out。

I

The oldest bank in the world is Monte Dei Paschi in Italy, founded in Tuscany in 1472 as a charity fund to lend money to the poor. However, according to Professor Felix Lessambo in his book “International Finance: New Participants and Global Markets”, “The first Forex market was established in Amsterdam, roughly 500 years ago. This possibility to freely trade currencies helped stabilize currency exchange rates. From Amsterdam, Forex trades throughout the whole world were initiated.”

II

In the 1980s, as the Internet was taking off, Thomson Reuters Group, famous for its media business, seized the opportunity and developed a system called “Reuters Monitor Dealing Service”, which was the world’s first that allowed currency traders to execute transactions through video terminals and became the industry standard for trading platforms.

In 2005, MetaQuotes launched the first retail trading platform MetaTrader 4, ushering in the “MetaQuotes era” of Forex trading. III The Forex market has been booming, according to the triennial report from the Bank for International Settlements (BIS), which shows that the daily trading volume of the over-thecounter (OTC) Forex market reached a whopping 7.5 trillion US dollars in April 2022, a 14% increase from 2019. The lion’s share of the trading volume came from five jurisdictions: the United Kingdom, the United States, Hong Kong, Singapore and Japan, which together accounted for 78% of the global total. Interestingly, for China, with the exception of Hong Kong SAR, has a strict ban on Forex margin trading.

III

The Forex market has been booming, according to the triennial report from the Bank for International Settlements (BIS), which shows that the daily trading volume of the over-thecounter (OTC) Forex market reached a whopping 7.5 trillion US dollars in April 2022, a 14% increase from 2019. The lion’s share of the trading volume came from five jurisdictions: the United Kingdom, the United States, Hong Kong, Singapore and Japan, which together accounted for 78% of the global total. Interestingly, for China, with the exception of Hong Kong SAR, has a strict ban on Forex margin trading.

IV

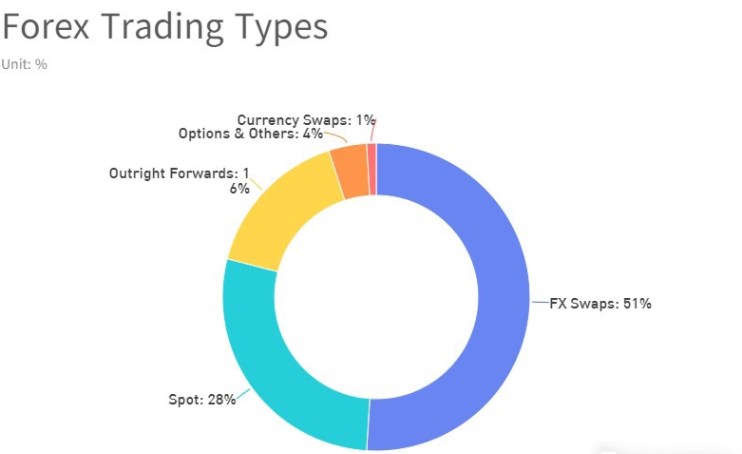

So what are the most popular types of transactions in the OTC Forex market? The BIS report reveals that swaps took the lead, with a 51% share of the daily trading volume, amounting to 3810.1 billion US dollars. Spot came in second, with a 28% share, amounting to 2106.58 billion. Outright forward was third, with a 16% share, amounting to 1163.4 billion. Options and others were fourth, with a 4% share, amounting to 304.4 billion. And currency swaps were fifth, with a 1% share, amounting to 123.93 billion.

V

What does a typical Forex trader look like? Most likely, a white male in his early forties. According to the data, 91.5% of Forex traders are men, and only 8.5% are women; among them, 67.1% are white, 12.1% are Asian, 11.1% are Latino / Hispanic, and 5.4% are black. However, the trend is changing, as the number of white traders is dropping every year, while the number of Asian and Latino / Hispanic traders is rising. When it comes to age, more than half of the traders are over 40 years old. VI The online trading platform market is growing fast. In 2022, it was worth 10.27 billion US dollars, and it is expected to grow by 6.7% in 2023, reaching 10.96 billion. It is expected to grow 7% annually through 2027, reaching a whopping 14.36 billion US dollars in that year.

VI

The online trading platform market is growing fast. In 2022, it was worth 10.27 billion US dollars, and it is expected to grow by 6.7% in 2023, reaching 10.96 billion. It is expected to grow 7% annually through 2027, reaching a whopping 14.36 billion US dollars in that year.

VII

There are thousands of online Forex brokers that offer retail traders a chance to trade in the interbank market. The largest one is the Australia-based IC Markets, which handles more than 500,000 orders per day, with a trading volume of over 15 billion US dollars. Some other big names are Forex.com, XM, Saxo Bank, Oanda and so on.

VIII

massive crash. The main reason is that the Forex market is made up of traders, so the currency prices depend on them, not on companies or shareholders. IX The Forex market takes a break on weekends (Saturdays and Sundays), as known by us all – except for the Middle East. That’s because in Islam, Friday is the day for prayers, so Sunday is actually the first day of the week for Muslims. In Arabic, Sunday (الأحد (literally means “the First Day”.

IX

The Forex market takes a break on weekends (Saturdays and Sundays), as known by us all – except for the Middle East. That’s because in Islam, Friday is the day for prayers, so Sunday is actually the first day of the week for Muslims. In Arabic, Sunday (الأحد (literally means “the First Day”.

X

The Forex market is likely to stay for a long long time. Even though digital currencies are becoming more popular and traditional currencies are becoming less common, currencies will always exist in one form or another. As long as there are different economic systems and countries。

177 Replies to “Top 10 Did-You-Know Trivia About Forex Trading”

Comments are closed.