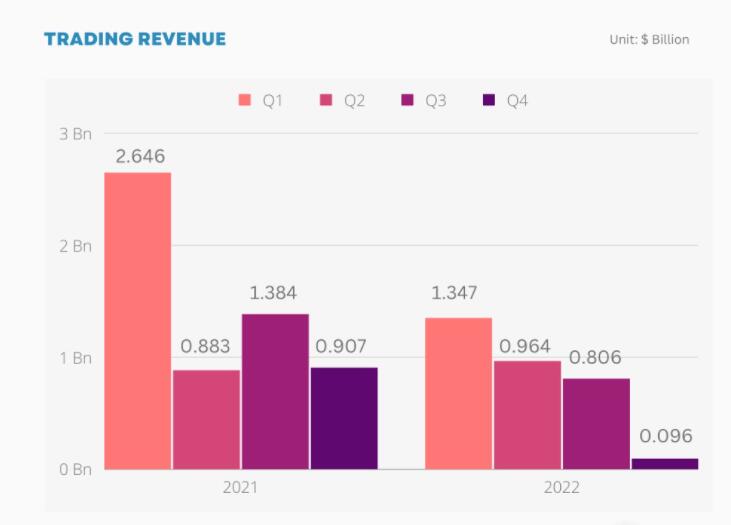

On February9, Credit Suisse announced that the net loss in the fourth quarter and annual repot of last year was 1.39 billion Swiss francs(CHF),lower than analysts estimates of a loss of 1.32 billion CHF, which brought the bank’s full-year loss to 7.3 billion CHF, worse than the 6.53 billion CHF expected by analysts and the worst since the ’08 financial crisis.

The earnings report also showed an unprecedented outflow of clients in Q4, which made it more difficult for CEO Ulrich Körner to bring back the bank to profitability by next year. After the

earnings report, Credit Suisse shares fell more than 7% premarket. As of Feb. 14, Credit Suisse shares still haven’t recovered to their previous levels.

Credit Suisse Had Some Rough Years Already

As a century-old bank, Credit Suisse has been hit by a series of scandals in recent years, including the Greensill collapse, the Archegos Capital crisis, and being found guilty of providing

money laundering assistance to criminals.These consecutive incidents have seriously damaged the bank’s reputation and resulted in significant losses, with quarterly losses reported consecutively. The most severe of these incidents was, undoubtedly, the Archegos Capital crisis, which caused a total loss over $10 billion in Wall Street. Credit Suisse and Nomura were among the most affected, with their stock prices plummeting, resulting in a combined market cap loss of $9 billion.

In addition, rumors of Credit Suisse’s bankruptcy surfaced and continued to escalate in October 2022. The impact of the rumors resulted in a stock price drop of up to 11.5%, and their 5-year credit default swap (CDS) reached the highest level since the 2008 financial crisis.

Furthermore, Credit Suisse has also made multiple rounds of job cuts and cost reductions. As early as September 2022, the bank announced plans to cut around 5,000 positions, eliminating almost one-tenth of its workforce. By late November, Credit Suisse announced that it would cut

approximately one-third of its inverstment banking team and nearly half of its research department due to its slowing chinese business and global business restructuring.

Reasons Behind the Q4 2022 Loss

The October bankruptcy rumors caused many clients to withdraw their assets, resulting in a significant outflow of funds for Credit Suisse. The total assets managed by the bank decreased by nearly 20% compared to the same period last year, falling to CHF 1.3 trillion. In October, outflows accounted for about two-thirds of the total outflows for the quarter. Despite this, net outflows for the fourth quarter reached CHF 110.5 billion, exceeding expectations. As a result, the total outflow of funds for the year 2022 amounted to CHF 123.2 billion, compared to CHF 30.9 billion in 2021.

The release of these financial reports had an adverse impact on Credit Suisse’ performance and reputation. However, the bank is now taking active measures to address this issue. CEO Körner stated that Credit Suisse is making active efforts to win back funds. Since October, the bank has contacted tens of thousands of clients, with the aim of recovering a significant

portion of the outflows in 2023, while the remainder will be recovered at a later date. Chief Financial Officer Dixit Joshi also stated that the Wealth Management department saw an inflow of funds in January, particularly from the Asia-Pacific region. These signs indicate that Credit Suisse is gradually regaining customer confidence and is actively addressing business issues in the Asia-Pacific region.

Despite Its Efforts, Will Credit Suisse Survive Out 2023?

Credit Suisse is implementing a self-rescue plan in response to investor pressure and to achieve business reform. As part of the plan, they are spinning off their investment banking business into an independent division and cut costs. They also raised CHF 4 billion through two rounds of fundraising, including selling a 9.9% stake to the Saudi National Bank. Credit Suisse’s First Boston has already taken shape, having acquired Michael Klein’s consulting firm and planning to go public or spin off the division by the end of 2024. Credit Suisse has successfully cut employee costs. In terms of labor costs, as mentioned above, Credit Suisse has begun to reduce its workforce and plans to cut 17% or 9,000 jobs by 2025.

From:Fazzaco