FP Markets (short for First Prudential Markets) is an established Australian broker with headquarters in Sydney, Australia, and an additional offshore office in St. Vincent and the Grenadines.

Facts about FP Markets:

Founded in 2005

Markets include CFDs on forex, stocks, indices, commodities, futures and cryptocurrencies

Excellent global foreign exchange trading broker

award winning company

Provides ECN/DMA trade execution

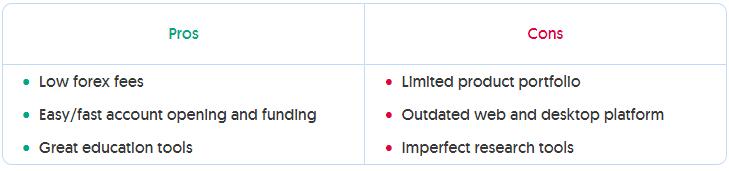

Advantages and disadvantages of FP Markets

FP Markets offers low forex fees. You can be up and running quickly as both account opening and deposits are super easy and fast. There are several excellent educational tools, such as demo accounts and e-books.

The product lineup at FP Markets is limited to forex, CFDs (equities, indices, metals) and cryptocurrencies. MetaTrader 4’s web and desktop trading platforms have an outdated design. The quality of research tools is uneven, especially when it comes to fundamental data, news or charting.

FP Markets is considered safe because it has a long track record and is regulated by the top-tier ASIC.

in 2005 ,FP Markets in obtained a license by ASIC – the strict financial authority responsible for regulating brokers in Australia. ASIC-licensed brokers have to meet many requirements before being able to offer services to clients – they have to maintain a capital of at least A$1 million and keep client money in segregated accounts – this ensures the broker cannot do what they want with your investments, and speeds up withdrawals. Negative balance protection is also guaranteed – your losses can never exceed the amount of money you have in your account. Just like in the EU and the UK, bonuses are banned but there is no leverage cap – Aussie brokers are free to legally offer high leverage to clients.

In 2018, FP Markets obtained a license by the Cypriot regulator CySEC – which means they are free to offer financial services in all EEA counties. Segregated accounts and negative balance protection are also a must in Europe, and the minimum capital a broker has to maintain is €730 000. However, all European brokers are also obligated to participate in compensation schemes – if your broker becomes insolvent, you could receive a compensation of up to €20 000 (if you are working with a EU broker). The maximum leverage retail clients could get access to is 1:30 on forex majors, and even less on more volatile assets – 1:20 on minor currency pairs, major indices and gold, 1:10 on commodities, 1:5 on equities and 1:2 on cryptocurrencies.

If you are working with FP Markets South Africa though, you will be dealing with the broker’s offshore company which is registered on St. Vincent and the Grenadines. We would usually be weary of any broker based in that country – since the local financial authority does not regulate forex brokers – but you need not worry in the case of well-known international brokerage brands like FP Markets. Such brokers have flawless reputation they would want to maintain at all costs and an offshore location does not change that. The offshore office only exist because the broker wants to remain competitive and avoid some regulations like the bonus ban and Europe’s leverage restrictions.