For investors, a broker has to be well-regulated before it gets chosen. There are many types of licenses, which not only determine in which jurisdiction(s) they are allowed to operate brokerage, but also the regulators that issue the license are closely related to how well a broker’s reputation is in the industry. Forex broker licensing has always been one of the most discussed topics in the FX B2B community. As a part of the 2022 Yearbook, let’s go back in 2022 and have a look at some of the firms that have obtained new licenses during the year, and find out what market trends they have revealed.

Typical Business Expansion Broker Cases in 2022

In October 2022, a triennial survey conducted by the Bank for International Settlements (BIS) showed that the size of global forex trading volume hit a record $7.5 trillion / day, an increase of 14% compared to the 2019 data of 6.6 trillion. During the year, a number of stories of firms extending business to new markets were covered here in Fazzaco. In general, prime markets such as the United States or the Switzerland tend to have higher threshold, and regulators there including CFTC, FINMA are, too, known for their stringency. As a result, there weren’t too many new listings in the prime markets this year – but still, companies like Trade.com secured a FINMA Broker-Dealer license, marking their entrance to the U.S market.

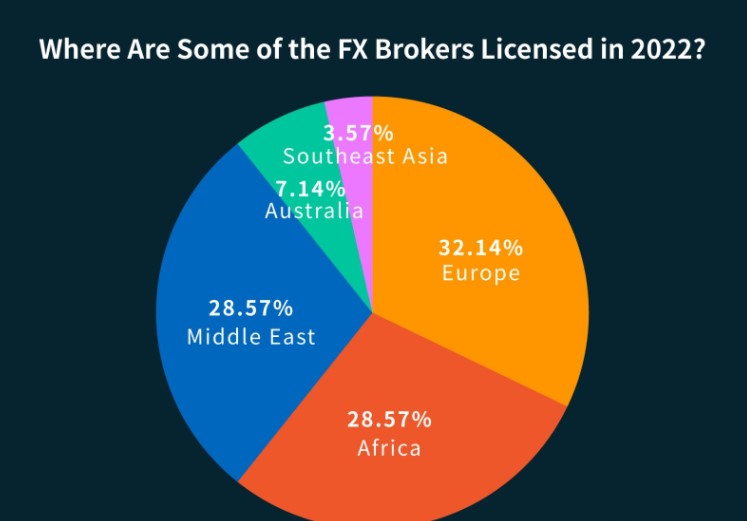

This article counts a total of 25 forex brokers that have applied for and received new licenses this year.

In May, the international multi-asset retail broker Exness expanded its presence in Africa, with securing a new license from the Capital Markets Authority of Kenya (CMA); in June, Currencycloud, a provider of B2B embedded cross-border solutions, announced that it was granted an Australian Financial Services (AFS) license by the Australian Securities and Investments Commission(ASIC); also in June, the retail broker Admirals obtained its South African license to operate CFDs in the country, and it opened up its first office in Cape Town.

Where Are Some of These FX Brokers Licensed in 2022?

– Europe still holds the lead

It can be seen that 89% of the newly granted licenses came from Europe, Middle East and Africa. Among them, Europe still holds the lead with a total of 9. Let’s look closer, and we’ll find out that brokers including Enigma Securities, REGIS-TR, Eurotrader and CXM Prime secured their licenses from UK FCA, a leading global financial market in a conventional sense. Others like ThinkMarkets, Equiti Group, M4Markets and Swissquote, on the other hand, obtained CySEC license to operate in Cyprus, a more popular market – because a CySEC license is usually the gateway to the European Union . More often than not, jurisdictions such as Cyprus, New Zealand, and Malta are more popular among startup brokers since the reporting requirements are not as stringent as they are in some other European countries.

– Middle East and Africa show strong momentum

The most noteworthy part is the strong momentum shown in the Middle East and Africa region (or MEA). E.g., CMA, the regulator of Kenya, has consecutively granted license to brokers including HotForex, Exness, INGOT Broker and Admirals. Africa is one of the world’s few places where online forex brokerage is still developing rapidly, and Kenya is undoubtedly the most prominent sub-market of all in 2022. The country is slowly rising up to be an emerging forex regulatory jurisdiction.

Besides, other parts of Africa such as the Financial Sector Conduct Authority (FSCA) of South Africa, as well as the offshore islands like Seychelles and Mauritius, have granted license to financial firms such as B2Broker, Zenfinex, NAGA and GEMFOREX etc.

Let’s turn our eyes to the Middle East. First of all, it is worth pointing out that the Dubai officials are putting up the world’s first authority completely concentrating on virtual assets known as the Dubai Virtual Asset Regulatory Authority (VARA). Several world renowned crypto exchanges have been given the pass by VARA, including Binance. In terms of forex trading, we have famous brokers such as Equiti, Century Financial, eToro, Zenfinex, Sygnum and MultiBank which is attributable to the Emirates’ yearslong efforts to build the country into the region’s financial hub.

Infrastructure-wise, Equinix has set up new data centers both in Africa and the Southeast Asia this year. Euqinix announced their plans to enter the South African market with a US$160 million data center investment in Johannesburg that augments its current footprint on the African continent in Nigeria, Ghana and Côte d’Ivoire. The new data center is expected to open mid-2024.

The initial investment of the new Malaysian data center of Equinix is approximately $40 million, which is scheduled to begin operations in Q1 2024.

Is MEA the New Destination for FX Brokers?

The story that data told us is that brokers are seemingly moving to the Middle East and Africa.

The financial ecosystem in the Middle East has been relatively developed. In the UAE, for example, foreign direct investment (FDI) in the first half of 2022 reached AED 13.72 billion, up 14.6% year-on-year. Dubai alone attracted a record 492 FDI projects in the first half of the year, up 80.2% year-on-year. In Dubai, a forex broker may start off their business right away by opening up an account in a local bank, just like Zenfinex, which was licensed in late November this year, after successfully securing a license from the Dubai Financial Services Authority (DFSA). Averagely, it costs about 32,000 AED to get a forex broker license in Dubai.

African FX market, however, is not a great choice to keep your trading and investment safe by comparison. The reasons are a lot, and first, although there are several offshore jurisdictions and countries that stood out recently like Kenya, the majority of African countries still lack regulation, which means less ideal investment protection. Second, the liquidity in the African forex market is much lower than in other markets around the world. This means that prices can fluctuate wildly and it can be difficult to get your money out when you need to. Finally, there is a general lack of education about forex trading among Africans. This means that many people are simply trading blindly. But because of all the reasons stated above, a lot of brokers are drawn here since the less developed a market is, the bigger the potential space to make big profits.

Final Thoughts

Broker licenses around the world vary depending on the regulatory framework of different jurisdictions, and brokers need to be clear about where they plan to operate, whether it is necessary to have a brick-and-mortar office presence, what requirements are there to open a bank account, and licensing budgets. In the process of applying for a license, details such as corporate organizational structure, paid up capital, registration fees, business plan, AML/KYC, customer onboarding process and so on will also be reviewed. Therefore, broker licensing has been, and will always be subject to constant changes.