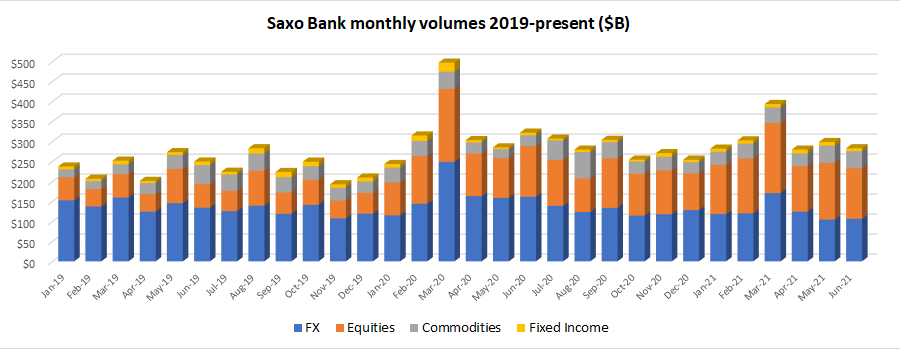

Copenhagen’s Saxo Bank has closed out its first half of 2021 with yet another weak month of client trading volumes, with June’s activity of $282.8 billion down 5% MoM from May’s $298.6 billion.

Saxo once again had one of its slowest months over the past 5+ years in its core FX trading business, with FX trading volumes coming in at $106.1 billion (although that was up slightly from May’s $104.3 billion). Equities trading was off 11% MoM to $126.7 billion, Commodities were down 2% to $42.6 billion, and Fixed Income fell 18% to $7.4 billion.

Saxo Bank averaged total monthly trading volumes of $287 billion in Q2-2021, down 12% from Q1’s $326 billion. In 2020 Saxo averaged $303 billion in monthly client trading volumes.

Saxo Bank recently launched crypto trading in a few geographies (Singapore, Australia, MENA) with a limited BTC, ETH and LTC offering, as was first exclusively reported by FNG – however it seems as though crypto trading hasn’t really made a dent yet in the company’s overall volumes. The company also made some recent management changes in Saxo Bank’s Hong Kong and China operations, a key focus area for Saxo now that it is controlled by Chinese investor Geely Group. Saxo also just named a new CFO from outside the FX industry, Mette Ingeman Pedersen.

Gizlilik, temizlik, iletişim… Her şey dört dörtlüktü. Özellikle Çankaya escort profilleri çok zarif ve dikkat çekiciydi.

Gizlilik, konfor ve kalite… Ankara Escort arayışlarımda tam anlamıyla ihtiyaçlarımı karşıladı.