This article provides a detailed overview of CH Markets and explains why investors should be cautious of this broker.

The Truth About CH Markets: Unregulated and Misleading Claims

CH Markets is a financial services company that offers online trading services in foreign exchange and other financial markets. The broker facilitates individuals and institutions looking to trade various financial instruments, including currency pairs, commodities, indices, and stocks. While the company doesn’t offer a proprietary trading app, clients can use the third-party trading platform, MT5. CH Markets provides four account types but doesn’t list the minimum deposit requirement. Still, it offers a 100% bonus on initial deposits to entice traders to sign up with them. The broker also provides referral rewards via its affiliate program, and connecting with the company is possible via telephone, email, and live chat.

Let’s check the regulation status of CH Markets

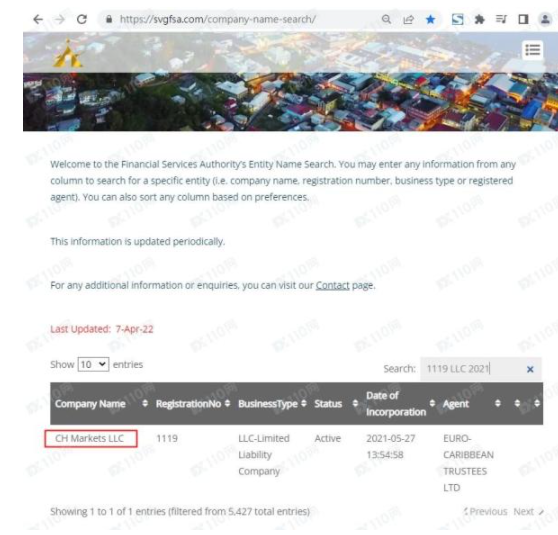

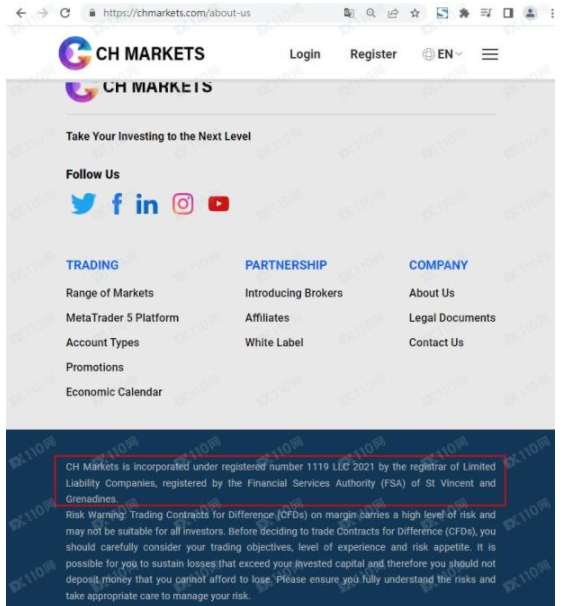

CH Markets is not a regulated broker. The company holds registration with the registrar of Limited Liability Companies, registered by the Financial Services Authority (FSA) of St Vincent and Grenadines under registration number 1119 LLC 2021. But, the SVGFSA neither acts as a financial regulator nor is authorized to issue forex and stock brokerage firms licenses. The company claims to have its roots in the United Kingdom, but the FCA register doesn’t provide any relevant information about its regulatory status.

The Red Flags of CH Markets: Why It’s Being Labeled as a Scam Broker

There are several reasons why CH Markets is considered a scam broker. First, the company claims to be based in the United Kingdom, but its official address is in Istanbul, which raises suspicions. Second, a company with a Turkish address registered with SVGFSA doesn’t make sense, and this inconsistency highlights the company’s possible intention to mislead clients concerning its physical location. Third, the broker tries to convince clients that the SVGFSA holds every right to regulate financial intermediaries while the body posts a disclaimer in this context. Lastly, the poor clientele feedback also suggests that the broker is fraudulent.