The Commodity Futures Trading Commission (CFTC) has published its monthly report for February 2023, revealing a month-on-month increase of 2.75 percent in retail FX deposits compared with the prior month.

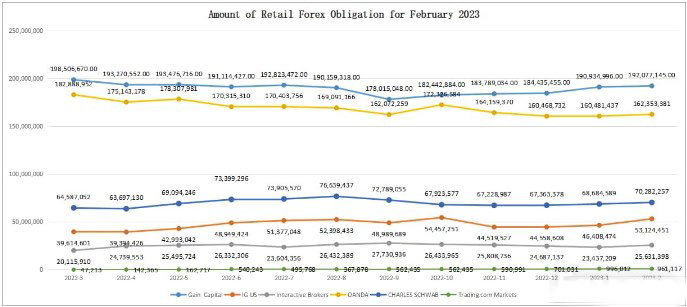

The CFTC has published its monthly report, which covers data for FCMs that are registered as Retail Foreign Exchange Dealers (RFEDs) and those included as broker-dealers that hold retail Forex obligations in the United States, namely Gain Capital Group LLC, IG US LLC, Interactive Brokers LLC, OANDA Corporation, CHARLES SCHWAB Futures & Forex LLC and Trading.com Markets.

According to the CFTC dataset, the FX funds held at the six registered brokerages hit over $504.4 million in February 2023, a month-on-month rise of 2.75 percent compared with the $490.9 million reported in January 2023. Excluding Trading.com Markets, the retail FX deposits of the five established brokers reached $503.5 million.

The chart listed below summarizes all the data of the six brokers during the latest 12 months. For purposes of comparison, the month-on-month change of the recent months has been outlined to illustrate the disparities.

In February 2023, only Trading.com Markets notched decrease in Retail Forex Obligation. The broker’s retail FX deposits experienced a 3.5 percent decline to $961,117 from last month’s $996,012.

In February, IG US’ Retail Forex deposits rose the most, increasing 14.5 percent over a monthly basis to $53.1 million from $46.4 million in the last month.

Interactive Brokers saw a 9.4 percent rise in its retail FX deposit to $25.6 million after four consecutive months of decline. CHARLES SCHWAB also saw an increase of 2.33 percent to $70.3 million, compared to $68.7 million in the month prior.

OANDA experienced an increase of $1.87 million to $162.4 million, compared to $160.5 million in the month prior, reflecting a 1.17 percent rise. Gain Capital saw an increase of $1.14 million to $192.1 million, compared to $191 million at the end of January 2023, or 0.6 percent higher month-over-month.

IG US Gained in Market Share While Gain Capital and OANDA Lose

Looking at the market share of these brokers, distribution changed slightly in February 2023 relative to the month prior.

For the rise in retail forex obligation, IG US increased in market share of 2 percent with a current share of 11 percent.

Gain Capital remained the leader in terms of market share, commanding a 38 percent share, 1 percent lower that the prior month. OANDA lose in market share of 1 percent with a current share of 32 percent.

The remaining brokers’ market share both kept unchanged. Interactive Brokers, CHARLES SCHWAB acquired 5 percent and 14 percent share respectively in this month. Trading.com Markets retained the last one of less than 1 percent.