What are CFDs?

A contract for difference (CFD) is a financial derivative that enables traders to speculate on the price movement of an underlying asset without actually owning it. CFDs monitor the value of assets such as stocks, indices, commodities, and currencies, allowing traders to benefit from price movements in either direction – whether the market is growing or dropping.

Benefits of CFD Trading

Leverage: One of the major benefits of CFD trading is the opportunity to employ leverage. This implies that traders may have a higher market exposure with a smaller initial investment, raising possible profits but also increasing the chance of losses.

Trading in both directions: CFD trading allows traders to speculate on both rising and falling markets, allowing possibilities to profit regardless of market circumstances.

Access to a diverse selection of markets: CFDs cover a broad range of asset classes, including equities, indices, commodities, and currencies, enabling traders to effortlessly diversify their portfolios.

Lower fees: Compared to conventional stock trading, CFD trading often offers cheaper fees, such as no stamp duty or charges, since traders do not own the underlying asset.

Hedging opportunities: CFDs may be used to hedge an existing investment portfolio by holding a short position, which helps to cover possible losses.

Risks Associated with CFD Trading

Leverage risk: While leverage can amplify potential profits, it also increases the risk of losses. It’s crucial for traders to manage their risk exposure carefully.

Market risk: The inherent risk of price fluctuations in the market can lead to losses.

Counterparty risk: The risk that the CFD provider fails to meet its obligations, which can impact the trader’s ability to close positions or withdraw funds.

Overtrading: The ease and accessibility of CFD trading can lead to overtrading, resulting in greater losses and reduced account balances.

Lack of ownership: As CFD traders don’t own the underlying asset, they don’t have voting rights or receive dividends, unlike traditional stockholders.

Top 5 CFD’s brokers to trade with

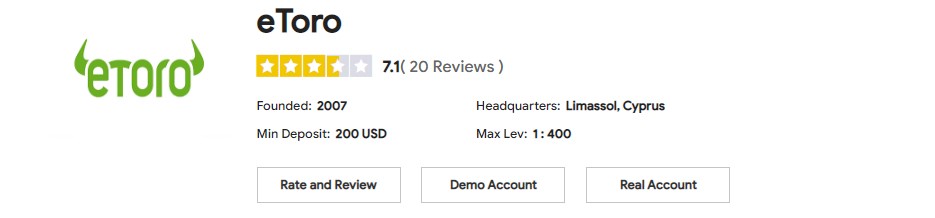

eToro: eToro is a popular social trading platform that offers CFD trading on various assets, including stocks, commodities, indices, and cryptocurrencies. The platform is user-friendly and provides an innovative copy-trading feature.

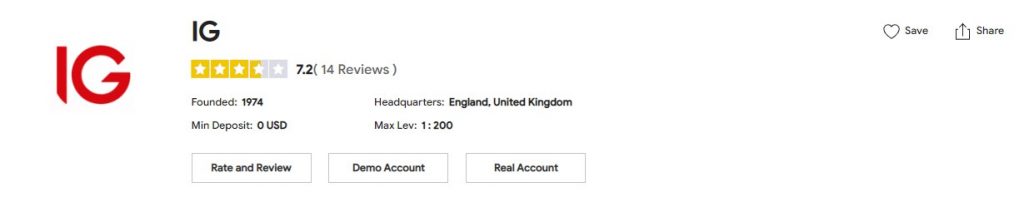

IG: Established in 1974, IG is one of the largest and most experienced CFD brokers, offering an extensive range of tradable instruments. They provide a robust trading platform, comprehensive educational resources, and excellent customer support.

Plus500: Plus500 is a leading CFD trading provider, offering a simple and intuitive platform with a wide range of assets, competitive spreads, and strong regulatory oversight.

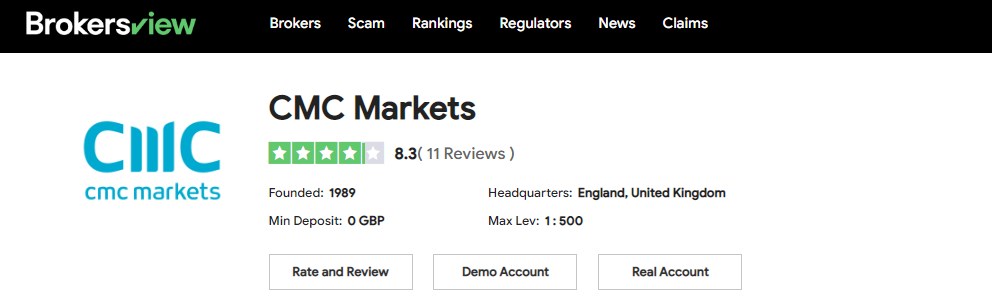

CMC Markets: CMC Markets is a well-established broker with a broad selection of CFD instruments, including stocks, indices, commodities, and more. They offer an award-winning trading platform and comprehensive educational resources for traders of all levels.、

XM: XM is a global broker known for its range of account types, competitive spreads, and extensive educational resources. They offer CFD trading on various assets such as stocks, indices, commodities, and cryptocurrencies.

Tips for Successful CFD Trading

Research and education: Knowledge is power. Traders should invest time in learning about the markets, the assets they’re trading, and CFD trading strategies.

Risk management: Implementing sound risk management strategies, such as setting stop-loss orders and maintaining a balanced portfolio, is essential for long-term success in CFD trading.

Diversification: Spreading investments across various asset classes and markets can help to minimize risk and optimize returns.

Keep emotions in check: Emotional decision-making can lead to impulsive and potentially detrimental trading decisions. Developing a solid trading plan and sticking to it can help maintain discipline and objectivity.

Choose a reputable broker: Selecting a reliable and regulated CFD provider is crucial for a secure and seamless trading experience. Compare the fees, platforms, and customer support offered by different brokers before making a decision.

Stay informed: Regularly follow market news, updates, and analysis to make well-informed trading decisions.

Practice with a demo account: Before diving into live trading, consider practicing with a demo account to familiarize yourself with the platform and hone your trading skills.