Global Retail FX and CFDs broker Admiral Markets has released its financial report for the first half of 2021, indicating a much slower six month period than either the first or second half of 2020, as volatility eased in the financial markets.

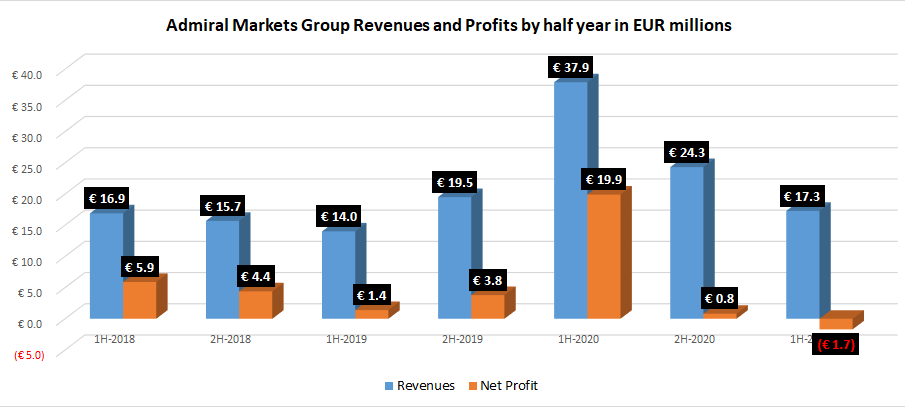

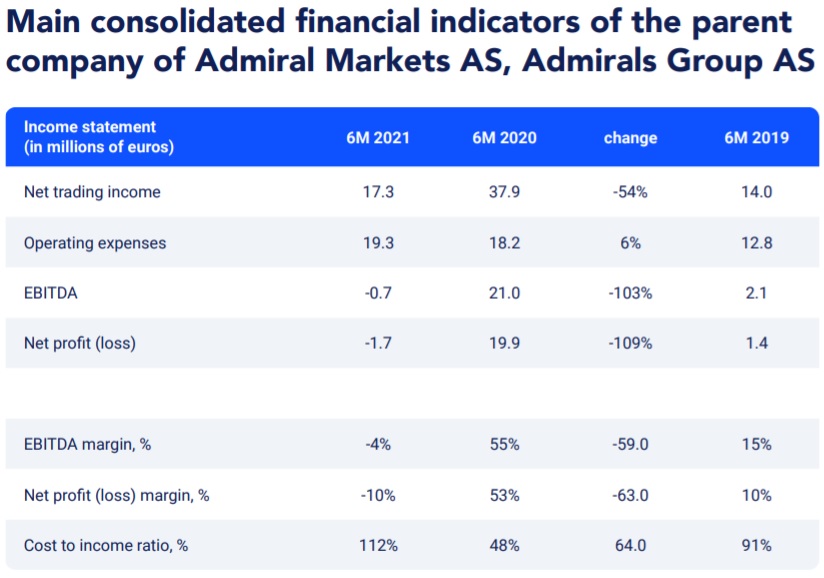

Revenues at parent Admirals Group AS in 1H-2021 was down by 29% as compared to the second half of 2020, and by more than 50% as compared to 1H-2020, coming in at €17.3 million. The company posted an EBITDA loss of €0.7 million, and a net loss of €1.7 million.

The first half of 2021 brought low volatility on the financial and commodity markets, which translated into a decline in revenue and profitability at Admirals. Despite the year-on-year decline from what was an unusual 2020, the company noted that it still saw a positive trend of a 24% increase in net trading income compared to 1H 2019. Along with the lower volatility, the transaction activity of clients also decreased, but not significantly compared with the same period in 2020, and still impressively higher than in the first half of 2019. The number of trades in 6M 2021 were still 90% higher than in 6M 2019. Value of trades in 6M 2021 was 49% higher than 6M 2019.

Admirals saw a total of €429 billion of client trades in the first six months of 2021, translating into monthly trading volumes of $85 billion at Admirals. That’s down only slightly from $87 billion monthly in 1H-2020.

The first six months of 2021 were still quite busy, with the company undergoing a major rebranding from Admiral Markets to Admirals.

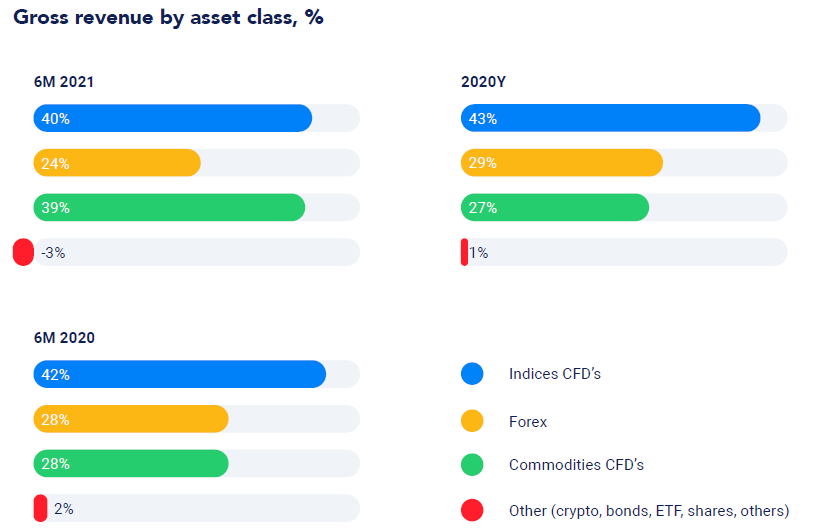

Revenue at Admirals was fairly balanced in 1H-2021, with 40% coming from Index CFDs, 39% from Commodity CFDs, and the remainder from FX and crypto. The company also reported active clients of 40,235 (2020 1H: 34,439), active accounts 48,638 (versus 42,051), and new applications 75,759 (versus 41,683).

Sergei Bogatenkov, CEO of Admiral Markets AS and of Admirals Group AS said that 2021 has been an excellent kick-off for the results the company is aiming to achieve in the following years:

Sergei Bogatenkov, CEO of Admiral Markets AS and of Admirals Group AS said that 2021 has been an excellent kick-off for the results the company is aiming to achieve in the following years:

During the first half-year of 2021, we received 82% more new client applications than in 2020 and 451% more than in the same period of 2019.

We want to demolish the boundaries that are keeping people from entering the financial world. We want to provide financial freedom to at least 10 million people by 2030. As a disruptor of the FinTech world, we introduce solutions to enable premium and easy access to financial markets. To everybody, everywhere, and anytime.

In 2021, we introduced Social Trading features, enabling beginners and people not yet so skilled in the trading and investing world. We have also launched virtual and physical debit cards, which allow our clients to use the funds from their multicurrency wallets and accounts. The first half of 2021 has been exceptional for us in terms of establishing ourselves in new regions.

In June, as the first financial company of European origin, we started operations in Jordan, opened an office in Amman. It is the implementation of our long-term strategy, one of the goals of which is to continue expanding in the Middle East and North Africa (MENA) region. On its way to expanding its global presence, another ground-breaking milestone was reached when we were attained a financial license in South Africa. Strategically we have been developing our operations worldwide. This is one of the cornerstones of the long-term vision we are aiming for in the next decade.

Helping clients achieve financial freedom depends largely on the top-tier products, continuous IT development, stable infrastructure, and 24/7 quality customer service we can offer for our clients. Nevertheless, we have managed to keep our expenses at level comparable to 2019 and 2020.

Admiral Markets’ financial report for 1H-2021 can be seen here.

Explore the ranked best online casinos of 2025. Compare bonuses, game selections, and trustworthiness of top platforms for secure and rewarding gameplaycasino bonus.