The Australian Securities and Investments Commission (ASIC) today released its 2020–21 Annual Report. The document provides an insight into ASIC’s activities during the past year, including licensing.

ASIC assesses applications for AFS licences and credit licences. The regulator also maintains a number of professional registers for registered companies, self‐managed superannuation funds (SMSFs), auditors, company auditors and liquidators.

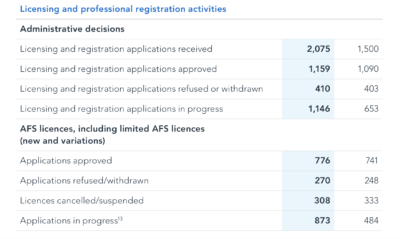

In 2020–21, ASIC finalised 1,965 applications in relation to AFS licences and credit licences, including applications for licences, cancellations and suspensions.

The regulator approved 776 AFS licences and 219 credit licences. It cancelled or suspended 308 AFS licences and 278 credit licences, the majority of which related to licensees voluntarily applying for licence suspension or cancellation.

A total of 384 AFS licence and credit licence applications were withdrawn or refused. Applications were often withdrawn after ASIC completed its assessment and informed applicants that they were unlikely to meet the statutory requirements to obtain a new or varied licence.

ASIC refused to accept 144 applications for lodgement, often due to material deficiencies in the information provided.

Liquidator applications are lodged with ASIC, which must refer the application to a committee that will decide whether the applicant should be registered. ASIC must register an applicant if the committee has decided that the applicant should be registered and the applicant produces evidence in writing that they have taken out adequate and appropriate professional indemnity and fidelity insurance.

Let’s note that there is an Enhanced regulatory sandbox (ERS) in Australia.

The ERS commenced operations on 1 September 2020. It allows natural persons and businesses to test certain innovative financial services or credit activities without first obtaining an AFS licence or credit licence.

The ERS supersedes the previous regulatory sandbox administered by ASIC, allowing testing of a broader range of financial services and credit activities for a longer duration (up to 24 months) than the superseded sandbox.

Join the community, celebrate the competition. Lucky Cola

Game on! Join our community and compete with the best Lodibet

Çankaya’da bir süredir aradığım kaliteli ve güvenilir deneyimi nihayet bu sitede buldum. Çankaya escort arayanlara kesinlikle tavsiye ediyorum.

İlk defa bir escort sitesinde bu kadar detaylı ve kullanıcı dostu filtreleme gördüm. Ankara escort kategorisindeki çeşitlilik çok etkileyici.

Çankaya’da gerçek bir deneyim yaşamak istiyorsanız bu siteyi mutlaka değerlendirin. Her profilde özen ve profesyonellik var.

Özellikle Çankaya Escort kategorisindeki profillerde kaliteyi anında hissediyorsunuz. Gözünüz kapalı tercih edebilirsiniz.

Yıllardır farklı platformlar denedim ama böyle bir Ankara Escort hizmet kalitesine ilk defa rastladım. Kesinlikle güvenle tavsiye ederim.

VIP hizmet arayanlar için Ankara Escort kısmı tam anlamıyla biçilmiş kaftan.

Cihazlar kategorisinden alışveriş yaptım. Cihazlar ürünleri kaliteli, hızlı kargolu ve kullanışlı. Tavsiye ederim.

Tansiyon Aleti ve Steteskop kategorisinden alışveriş yaptım. Tansiyon Aleti ve Steteskop ürünleri kaliteli, hızlı kargolu ve kullanışlı. Tavsiye ederim.