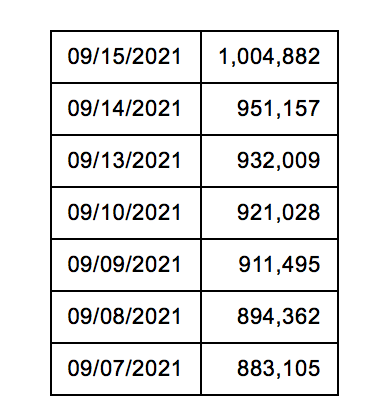

International derivatives marketplace CME Group Inc (NASDAQ:CME) has announced that its SOFR futures contracts reached a new record, surpassing one million contracts of open interest on September 15.

SOFR futures open interest reached 1,004,882 contracts on September 15th, marking its seventh-consecutive record open interest day.

SOFR futures open interest reached 1,004,882 contracts on September 15th, marking its seventh-consecutive record open interest day.

Agha Mirza, CME Group Global Head of Rates and OTC Products, comments:

“We are pleased with the significant progress the market has made in adopting CME SOFR futures since we introduced these contracts nearly three and a half years ago. This milestone is reflective of the strong growth we’ve seen throughout the SOFR ecosystem since CME implemented SOFR-based fallbacks on March 29 of this year.

In August, SOFR futures volume increased 195% year over year to 125,000 contracts per day and our OTC SOFR swaps volume rose to $65 billion in notional volume cleared.”

Additionally, SOFR-linked open interest, which includes open interest in SOFR futures and options plus any Eurodollar futures and options open interest beyond June 2023, has increased to 20.2 million contracts since the adoption of SOFR-based fallbacks. Total SOFR-linked open interest has increased to 38% of total short-term interest rate futures and options open interest at CME Group.

CME Group is the only entity to offer Eurodollar futures and options, a holistic SOFR solution that includes SOFR futures, options, cleared swaps and Term SOFR, as well as BSBY futures ensuring market participants have a choice of deeply liquid risk management tools.

SOFR futures and cleared OTC swaps are listed with and subject to the rules of CME.

Very informative blog article.Really thank you! Awesome.

I am an mother who is 43 years old thank you.

slots for real money slot games slots games

I do believe all of the ideas you have offered in your post.They are very convincing and can definitely work.Still, the posts are very brief for starters. Could you please prolong them abit from subsequent time? Thanks for the post.

A big thank you for your blog post.Really looking forward to read more. Will read on…Loading…

Thanks a lot for the blog article.Really looking forward to read more. Much obliged.

Thanks for sharing, this is a fantastic article post.Really thank you! Fantastic.

Hey, thanks for the article post.Really looking forward to read more. Much obliged.

Thank you ever so for you blog article.Really looking forward to read more. Want more.

Im thankful for the blog article.Thanks Again. Keep writing.

Thanks a lot for the article post.Much thanks again. Keep writing.

Thanks-a-mundo for the blog.Really looking forward to read more. Want more.

Fantastic blog article.Really thank you! Keep writing.

I’m really enjoying the design and layout of your blog.It’s a very easy on the eyes which makes it much more enjoyable for me to comehere and visit more often. Did you hire out a developer tocreate your theme? Great work!

It’s an amazing paragraph for all the online visitors; theywill take advantage from it I am sure.

Great article. I’m experiencing some of these issues as well..

hydroxychloroquine 400 hydroxychloroquine sulfate generic – hydroxychloroquine plaquenil

Good job on this article! I really like how you presented your facts and how you made it interesting and easy to understand. Thank you.Learn more

Hi, its pleasant paragraph about media print, we all be awareof media is a wonderful source of facts.

prednisone indications prednisone side effects

That is a really good tip especially to those fresh to the blogosphere.Short but very precise information… Many thanks for sharing this one.A must read article!

scoliosisIt’s going to be finish of mine day, however before ending I am reading this fantastic postto increase my experience. scoliosis

Wow that was unusual. I just wrote an incredibly long comment but after I clickedsubmit my comment didn’t show up. Grrrr… well I’m not writingall that over again. Anyway, just wanted to say fantastic blog!

Hi colleagues, how is the whole thing, and what you would like to say about this article, in my viewits truly amazing in favor of me.

There is certainly a lot to find out about this issue. I really like all the points you’ve made.

I am so grateful for your article.Much thanks again. Much obliged.

Have you ever heard of second life (sl for short). It is basically a game where you can do anything you want. Second life is literally my second life (pun intended lol). If you want to see more you can see these sl articles and blogs

I’m not sure exactly why but this blog is loading incredibly slow for me. Is anyone else having this problem or is it a issue on my end? I’ll check back later on and see if the problem still exists.

I truly appreciate this article.Really looking forward to read more. Really Cool.

Usually I don’t read post on blogs, but I wish to say that this write-up very forced me to try and do so! Your writing style has been amazed me. Thanks, quite nice post.

Great remarkable issues here. I am very satisfied to see your post. Thank you so much and i am taking a look forward to touch you. Will you kindly drop me a mail?

ivermectin tablets for humansivermectin tablets

Aw, this was an incredibly nice post. Finding the time and actual effort to create a very good articleÖ but what can I sayÖ I procrastinate a lot and never manage to get nearly anything done.

plaquenil pill chloroquine mechanism of action

Hi, I think your website might be having browser compatibility issues. When I look at your blog in Opera, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, amazing blog!

Hi there, You have done a fantastic job. I will definitely digg it and individually recommend to my friends. I’m sure they’ll be benefited from this site.

I am curious to find out what blog system you’re using? I’m experiencing some minor security issues with my latest site and I would like to find something more safe. Do you have any solutions?

Thanks for your marvelous posting! I certainly enjoyed reading it, you are a great author.I will be sure to bookmark your blog and will eventually come back down the road. I want to encourage yourself to continue your great writing, have a nice day!

It’s really a great and useful piece of info. I am glad that you shared this useful info with us. Please keep us informed like this. Thank you for sharing.

Hi there! I know this is kinda off topic but I’d figured I’d ask. Would you be interested in trading links or maybe guest writing a blog post or vice-versa? My website discusses a lot of the same topics as yours and I believe we could greatly benefit from each other. If you’re interested feel free to shoot me an email. I look forward to hearing from you! Awesome blog by the way!

Hey There. I found your blog using msn. This is a very well written article. I’ll make sure to bookmark it and return to read more of your useful information. Thanks for the post. I’ll definitely comeback.

It’s laborious to seek out educated individuals on this topic, but you sound like you realize what you’re speaking about! Thanks

Hey, you used to write great, but the last several posts have been kinda boring… I miss your super writings. Past few posts are just a bit out of track! come on!

Hello! I know this is kinda off topic however , I’d figured I’d ask. Would you be interested in exchanging links or maybe guest authoring a blog article or vice-versa? My website addresses a lot of the same topics as yours and I feel we could greatly benefit from each other. If you are interested feel free to send me an email. I look forward to hearing from you! Wonderful blog by the way!

In this great pattern of things you actually receive a B- with regard to effort. Where exactly you actually confused us ended up being on the specifics. As as the maxim goes, details make or break the argument.. And it could not be much more true in this article. Having said that, allow me tell you just what did do the job. Your article (parts of it) can be really persuasive and that is most likely why I am making an effort to comment. I do not really make it a regular habit of doing that. 2nd, even though I can notice a leaps in reason you make, I am not necessarily sure of exactly how you seem to connect the points that make the actual conclusion. For the moment I will, no doubt yield to your issue but wish in the future you actually link your dots much better.

There are some attention-grabbing cut-off dates on this article but I don’t know if I see all of them middle to heart. There is some validity but I will take hold opinion until I look into it further. Good article , thanks and we would like more! Added to FeedBurner as effectively

Awesome issues here. I am very glad to peer your post.Thanks a lot and I’m having a look forward to touch you.Will you kindly drop me a mail?

Really appreciate you sharing this blog.Much thanks again. Really Great.

Wow, great blog. Will read on…

Great, thanks for sharing this blog.Really thank you! Keep writing.

Thanks-a-mundo for the post.Really thank you! Fantastic.

Awesome issues here. I’m very satisfied to peer your post.Thank you a lot and I’m taking a look forward to contact you.Will you kindly drop me a mail?

Fantastic post.Thanks Again. Fantastic.

Hey, thanks for the article post.Much thanks again. Awesome.

Piece of writing writing is also a excitement, if you be acquainted with then you can write or else it is difficult to write.

I really liked your blog article.Really thank you! Great.

Really appreciate you sharing this blog.Thanks Again. Great.

Im thankful for the article. Want more.

Say, you got a nice article post.Thanks Again.

Thanks again for the post.Thanks Again. Want more.

Really informative article post.Thanks Again. Cool.

This is an interesting find. Grateful I discovered your blog post!

I cannot thank you enough for the article.Thanks Again. Fantastic.

Im obliged for the blog post.Really looking forward to read more. Want more.

Very good article post.Really looking forward to read more. Keep writing.

louis vuitton travel case ??????30????????????????5??????????????? ????????

Major thanks for the blog.Thanks Again. Keep writing.

I am so grateful for your blog post.Thanks Again. Want more.

Major thanks for the article post.Really thank you! Want more.

I’m not sure where you’re getting your info,but great topic. I needs to spend some time learning much more or understanding more.Thanks for fantastic info I was looking for this infofor my mission.

There’s certainly a lot to find out about this issue. I really like all of the points you have made.

Fantastic article.Much thanks again. Keep writing.Loading…

Thanks-a-mundo for the blog article.Much thanks again. Great.

ArnulfoLkf Forxa Horizon Pc Password Txt 0 09 Kb JoshuaJoshua Gear Template Generator Program Torrent (Sadie) ForestBram

LED allows you to visually monitor the voltage supply submitted to the memory chip.

Thanks a lot for the blog article.Really thank you! Great.

over the counter ed pills – best ed pills over the counter ed pills

This is one awesome article post.Really thank you! Great.

Im obliged for the article post.Much thanks again. Keep writing.

northline apartments park villa apartments henderson apartments for rent

I like the valuable info you provide in your articles. I will bookmark your blog and check again here frequently. I am quite certain I will learn a lot of new stuff right here! Best of luck for the next!

I savor, cause I found just what I used to be having a look for. You have ended my four day long hunt! God Bless you man. Have a great day. Bye

Appreciate you sharing, great article.Much thanks again. Much obliged.

I really enjoy the blog article. Really Cool.

Thanks so much for the blog.Really looking forward to read more. Great.

I really like and appreciate your blog. Awesome.

Major thankies for the article.Thanks Again. Cool.

Thank you for your article post.Really thank you! Great.

A big thank you for your article post.Really looking forward to read more. Fantastic.

I blog frequently and I seriously thank you for your information. This article has truly peaked my interest. I will book mark your blog and keep checking for new information about once a week. I subscribed to your RSS feed too.

I’m now not sure the place you are getting your information, however goodtopic. I needs to spend some time learning more orfiguring out more. Thank you for magnificentinformation I was searching for this infofor my mission.

Generally I do not read article on blogs, however I would liketo say that this write-up very compelled meto try and do it! Your writing taste has been surprised me.Thanks, very nice article.

I really enjoy the blog article.Much thanks again. Great.

There is certainly a great deal to find out about this subject. I love all of the points you’ve made.

I really liked your blog post. Want more.

Bitexen güvenilir mi öğrenmen için tıklayın ve bitexen güvenilir mi sorusunahemen cevap bulun. Bitexen güvenilir mi? İştecevabı.

Very good post.Thanks Again. Want more.

Hey there! Do you use Twitter? I’d like to follow you if that would be okay. I’m definitely enjoying your blog and look forward to new posts.

How do I know what type of glazing is right for a window?

I really enjoy the article.Really looking forward to read more. Great.

Liking the article.. thank you I enjoy you giving out your point of view.. Appreciate the admission you given.. Is not it great once you discover a great publish?

Enjoyed every bit of your blog post. Fantastic.

Appreciate you sharing, great blog article.Thanks Again. Great.Loading…

What’s Happening i am new to this, I stumbled upon this I’ve found It positively helpful and it has aided me out loads.I hope to give a contribution & aid other customers like its helpedme. Great job.

Today, I went to the beach front with my kids.

Heya i am for the primary time here. I found this boardand I find It truly useful & it helped me out much. I’m hoping to give something again and help others like you helped me.

Im obliged for the blog article.Much thanks again. Great.

I really enjoy the blog article.Thanks Again. Fantastic.

Coi Trực Tiếp Viettel Vs Bình Dương Tại V League 2021 Ở Kênh Nào? bong da truc tuyenĐội tuyển chọn nước Việt Nam chỉ cần thiết một kết trái hòa có bàn thắng để lần loại hai góp mặt tại World Cup futsal. Nhưng, nhằm làm được điều đó

I will immediately grab your rss as I can’t in finding your email subscription hyperlink or newsletter service.Do you have any? Kindly allow me recognise sothat I may just subscribe. Thanks.

Major thanks for the blog.Thanks Again. Want more.

I enjoy reading through an article that can make men and women think.Also, thank you for allowing me to comment!

Muchos Gracias for your blog post. Want more.

Very excellent info can be found on blog . “I don’t know what will be used in the next world war, but the 4th will be fought with stones.” by Albert Einstein.

Aw, this was a very nice post. In concept I wish to put in writing like this additionally ?taking time and actual effort to make an excellent article?however what can I say?I procrastinate alot and on no account appear to get something done.

Thanks-a-mundo for the article. Want more.

Thank you for your blog article. Fantastic.

I value the article.Thanks Again. Keep writing.

Hello there, just became alert to your blog through Google, and found that it is really informative.I’m going to watch out for brussels. I’ll appreciate if you continue this in future.Numerous people will be benefited from your writing.Cheers!

I am now not certain the place you are getting your info, however great topic. I needs to spend a while studying more or understanding more. Thank you for excellent info I was looking for this information for my mission.

Hey, thanks for the blog article.

wow, awesome blog article. Want more.

ivermectin over the counter canada generic stromectol – ivermectin uk

Appreciate you sharing, great blog post.

Excellent post however , I was wanting to know if you could write a litte more on this subject? I’d be very thankful if you could elaborate a little bit further. Many thanks!

Hey There. I discovered your blog the usage of msn. This is a really smartly written article. I will make sure to bookmark it and return to learn more of your useful info. Thanks for the post. I’ll certainly comeback.

Thanks for the blog.Really looking forward to read more. Want more.

always i used to read smaller content that as wellclear their motive, and that is also happening with this article which I am reading now.

Your style is so unique compared to other folks I’ve read stuff from. I appreciate you for posting when you’ve got the opportunity, Guess I’ll just book mark this blog.

fineco bank reviews uk of America offers a few various rates rates.

Very efficiently written story. It will be beneficial to everyone who utilizes it, as well as myself. Keep up the good work – looking forward to more posts.

I loved your article post.Really thank you! Much obliged.

Really appreciate you sharing this article post.Thanks Again. Really Cool.

Hey, thanks for the blog article.Really thank you! Great.

I appreciate you sharing this blog article.Really looking forward to read more. Cool.

Im grateful for the blog post.Really thank you! Much obliged.

Wonderful blog! I found it while surfing around on Yahoo News.Do you have any suggestions on how to get listed in Yahoo News?I’ve been trying for a while but I never seem to getthere! Many thanks

I really like your writing style, good info, regards for posting :D. “Faith is a continuation of reason.” by William Adams.

I enjoy reading an article that can make men and women think.Also, thank you for permitting me to comment!

Hello there! I could have sworn I’ve been to this blogbefore but after going through many of the articles I realizedit’s new to me. Anyhow, I’m certainly pleased I came across it and I’ll be bookmarking it and checking back regularly!

There’s definately a great deal to know about this issue. I really like all the points you’ve made.

Im obliged for the article post.Really looking forward to read more.

Wow, great article post.Much thanks again. Keep writing.

I value the post.Really thank you!

I never thought about it that way, but it makes sense!Static ISP Proxies perfectly combine the best features of datacenter proxies and residential proxies, with 99.9% uptime.

Say, you got a nice blog article.Really thank you! Really Great.

I loved your article.Much thanks again. Fantastic.

Really no matter if someone doesn’t understand then its up to other visitors that they will assist, so here it occurs.

I like it whenever people get together and share thoughts. Great blog, continue the good work!

It?¦s really a nice and helpful piece of information. I?¦m glad that you just shared this helpful info with us. Please stay us informed like this. Thank you for sharing.

great issues altogether, you just won a brand new reader. What would you recommend about your put up that you simply made a few days ago? Any certain?

Fantastic blog.Really thank you! Will read on…

Very informative article post.Much thanks again. Will read on…

Appreciate you sharing, great article post.Much thanks again. Much obliged.

Great blog post. Really Cool.

Very informative blog article.Really looking forward to read more.

Very neat article post.Really looking forward to read more. Much obliged.

I cannot thank you enough for the blog.Much thanks again. Much obliged.

I never thought about it that way, but it makes sense!,Docker代理是什么?

I really like and appreciate your article.Really thank you! Cool.

wow, awesome blog post.Much thanks again. Fantastic.

I truly appreciate this post.Really thank you! Fantastic.

Thanks-a-mundo for the article post.Really thank you! Great.

Thanks for sharing, this is a fantastic blog post.Really looking forward to read more. Will read on…

I really like and appreciate your blog article.Really thank you! Cool.

Im grateful for the blog.Really looking forward to read more. Want more.

Very neat post.Thanks Again.

generic tadalafil – goodrx tadalafil 5 purchasing tadalafil online

ivermectine posologie stromectol for sale ivermectin generic cream

I truly appreciate this article post. Want more.

Dissertation topics in education dissertationhelpvfh.com dissertation help service

A round of applause for your article. Cool.

Its great as your other content : D, thanks for putting up. “Age is a function of mind over matter if you don’t mind, it doesn’t matter.” by Leroy Robert Satchel Paige.

I loved your post. Really Great.

I never thought about it that way, but it makes sense!

I truly appreciate this article.Really thank you! Great.

Aw, this was a really good post. Finding the time and actual effort to make a good articleÖ but what can I sayÖ I procrastinate a whole lot and don’t seem to get nearly anything done.

Awesome article.Really thank you! Keep writing.

A round of applause for your article post.Really thank you! Want more.

Very nice post. I just stumbled upon your blog and wished tosay that I’ve truly enjoyed surfing around your blog posts.In any case I’ll be subscribing to your feed and I hope you write again soon!

I am so grateful for your post. Want more.

Enjoyed every bit of your blog.Thanks Again. Really Great.

Im thankful for the article post. Keep writing.

I am curious to find out what blog platform you happen to be using?I’m having some minor security issues with my latest blog and I would like to find somethingmore safe. Do you have any recommendations?

Hey, thanks for the article post.Really looking forward to read more. Fantastic.

I love what you guys are usually up too. This sort of clever workand exposure! Keep up the very good works guys I’veincorporated you guys to my own blogroll.

I wanted to thank you for this good read!! I certainly loved every bit of it. I have got you bookmarked to look at new stuff you post…

Thanks for the blog post.Really thank you! Will read on…

Fantastic article.Thanks Again. Will read on…

I don’t normally comment but I gotta admit appreciate it forthe post on this amazing one :D.Feel free to visit my blog :: cyclical ketogenic

Sitedeki tüm içerikler SEO uyumlu ve kullanıcıyı yanıltmıyor. Ankara escort arayan herkes için güvenilir bir kaynak.

Çankaya’da bir süredir aradığım kaliteli ve güvenilir deneyimi nihayet bu sitede buldum. Çankaya escort arayanlara kesinlikle tavsiye ediyorum.

izmir hava durumu; izmir için hava durumu en güncel saatlik, günlük ve aylık tahminler.

Hello mates, pleasant piece of writing and nice arguments commented here, I am truly enjoying by these.

Sitedeki tüm profiller özenle seçilmiş, fotoğraflar gerçek ve tutarlı. Özellikle Ankara escort arayanlar için güvenli bir ortam sunuyor.

Major thankies for the blog post.Really thank you! Cool.

It’s actually a nice and helpful piece of information. I’m satisfied that you shared this useful information with us. Please stay us informed like this. Thanks for sharing.

A motivating discussion is definitely worth comment. Ido think that you ought to write more on this subject, it might not be a taboo subjectbut generally people don’t talk about such subjects.To the next! Kind regards!!

Ankara Escort deneyimi arayanlar için doğru adresi sonunda buldum. Ankara Escort platformu üzerinden mükemmel bir hizmet aldım.

Ankara Escort konusunda güvenilirlik arayanlar için bu site tartışmasız lider. Her aşamada memnun kaldım.

Im thankful for the blog article.Really looking forward to read more. Much obliged.

Post writing is also a excitement, if you know then youcan write or else it is difficult to write.

how to use tinder , tinder loginwhat is tinder

Thank you for your blog article. Great.

A round of applause for your blog post.Really looking forward to read more.

I never thought about it that way, but it makes sense!Static ISP Proxies perfectly combine the best features of datacenter proxies and residential proxies, with 99.9% uptime.

A big thank you for your blog post.Really thank you! Awesome.

Thank you for your post.Really thank you! Keep writing.

I’m really impressed with your writing skills as well as with the layout on your blog.Is this a paid theme or did you modify it yourself?Either way keep up the nice quality writing, it is rare tosee a great blog like this one these days.

I cannot thank you enough for the post.Thanks Again. Keep writing.

I really like and appreciate your article post.Really thank you! Really Cool.

We are looking for some people that are interested in from working their home on a part-time basis. If you want to earn $500 a day, and you don’t mind developing some short opinions up, this is the perfect opportunity for you!

We are searching for some people that are interested in from working their home on a part-time basis. If you want to earn $200 a day, and you don’t mind developing some short opinions up, this might be perfect opportunity for you!

Thanks for sharing, this is a fantastic article post. Really Great.

Thank you ever so for you blog.Thanks Again. Awesome.

Thanks a lot for the article post.Really thank you! Fantastic.

A round of applause for your article post.Really thank you! Cool.

I was suggested this blog by my cousin. I am not sure whether this post iswritten by him as nobody else know such detailed about my difficulty.You’re incredible! Thanks!

Thanks for sharing, this is a fantastic article. Keep writing.

Im obliged for the blog.Much thanks again. Really Great.

When some one searches for his essential thing, so he/she needs to be available that in detail,thus that thing is maintained over here.

Thank you ever so for you blog. Fantastic.

I truly appreciate this article post.Really looking forward to read more. Want more.

I appreciate you sharing this blog.Much thanks again. Really Great.

Im obliged for the blog article.Really thank you! Keep writing.

A round of applause for your blog post.Really looking forward to read more. Keep writing.

canadian pharmacy lyrica – trusted canadian pharmacy canadian pharmacy ltd

Major thankies for the post.Really looking forward to read more. Keep writing.

I’ll immediately snatch your rss as I can’t find your e-mail subscription hyperlink or newsletter service. Do you have any? Please let me know in order that I may just subscribe. Thanks.

continuously i used to read smaller articles or reviews which also clear their motive, and that is also happeningwith this post which I am reading here.

What’s Happening i am new to this, I stumbled upon this I have found It absolutely helpful and it has helped me out loads. I hope to contribute & aid other users like its helped me. Great job.

I am now not positive the place you are getting your info, however great topic. I must spend a while finding out more or figuring out more. Thank you for magnificent info I used to be in search of this information for my mission.

precision rx specialty pharmacy 24 hr pharmacy near me

Im thankful for the article.Much thanks again. Much obliged.

wow, awesome blog.Really looking forward to read more. Will read on…

Hi there just wanted to give you a brief heads up and let you knowa few of the images aren’t loading properly. I’m not surewhy but I think its a linking issue. I’ve tried it in two different browsers and both show the sameresults.

I enjoy what you guys are up too. This sort of clever work and coverage! Keep up the amazing works guys I’ve incorporated you guys to our blogroll.

Normally I do not learn article on blogs, however I would like to say that this write-up very compelledme to check out and do it! Your writing style has been surprised me.Thank you, quite great post.

Fastidious answer back in return of this matter with firm arguments and telling all regarding that.

Hi, usually are you too great? Your own personal writing widens my information. Give thanks you.

water pill hydrochlorothiazide what is hydrochlorothiazide] chlorthalidone vs hydrochlorothiazide

Aw, this was a very good post. Taking a few minutes and actual effort to create a great articleÖ but what can I sayÖ I procrastinate a whole lot and never manage to get anything done.

Great post. I was checking continuously this blog and I am impressed! Extremely useful information specially the last part 🙂 I care for such info a lot. I was looking for this particular info for a very long time. Thank you and good luck.

Hi there! Do you know if they make any plugins toassist with SEO? I’m trying to get my blog to rankfor some targeted keywords but I’m not seeing very good gains.If you know of any please share. Appreciate it!

Hello There. I found your blog using msn. This is a very well written article.I will make sure to bookmark it and come back to readmore of your useful information. Thanks for the post.I’ll definitely return.

Nicely put, Cheers!help writing essay help with dissertation proposal article writing services

My family every time say that I am killing my time hereat net, but I know I am getting know-how everyday by reading thes good articles or reviews.

WOW just what I was looking for. Came here bysearching for diagnostic essay

I have read so many articles or reviews regarding the blogger lovers however this paragraph is truly anice paragraph, keep it up.

I really enjoy the blog post.Really looking forward to read more. Cool.

Awesome blog.Really looking forward to read more. Keep writing.

Really appreciate you sharing this article post.Really looking forward to read more. Really Great.

Really enjoyed this blog article. Really Great.

A fascinating discussion is worth comment. I believe that you ought to publish more on this topic,it might not be a taboo subject but usually people don’t speak about these subjects.To the next! Many thanks!!

I really liked your blog post.Really looking forward to read more. Really Cool.

wall street market darknet link darknet markets 2021

janumet vs metformin best metformin brand benefits of metformin weight loss how metformin works in the body

Very neat article.Really looking forward to read more. Cool.

Hi, I do believe this is a great blog. I stumbledupon it 😉 I may return once again since i have saved as a favorite it. Money and freedom is the best way to change, may you be rich and continue to guide other people.

Thank you ever so for you blog article.Really thank you! Fantastic.

Aw, this was an exceptionally nice post. Finding the time and actual effort to make a good articleÖ but what can I sayÖ I hesitate a lot and don’t seem to get nearly anything done.

I think this is a real great blog post. Great.

Heya i am for the first time here. I came across thisboard and I find It truly useful & it helped me out much. I hope to give something back andaid others like you helped me.

Post writing is also a excitement, if you be familiar with after that you can write otherwise it is complicated to write.

Its wonderful as your other articles : D, thanks for putting up. “Slump I ain’t in no slump… I just ain’t hitting.” by Yogi Berra.

A big thank you for your post. Really Great.

A big thank you for your blog post.Really looking forward to read more.

rx pharmacy online 24: mexican pharmacy online – best rx pharmacy online

Thanks for the article.Really looking forward to read more. Cool.

I am not sure where you are getting your information, but greattopic. I needs to spend some time learning much more or understandingmore. Thanks for great info I was looking for this information formy mission.

I cannot thank you enough for the blog post.Much thanks again. Cool.

Excellent post. I’m dealing with some of these issues aswell..My blog – aniene.net

I am extremely impressed with your writing skills as well as with the layout on your blog.Is this a paid theme or did you customize it yourself?Anyway keep up the excellent quality writing, it israre to see a great blog like this one today.

arıza kodları vestel Terry Paul arıza kodları ve anlamları Rosemary Weaver p0087 arıza kodu vw Yahya Schultz p2279 arıza kodu vw Hamish Parker p0299 arıza kodu vw

Awesome article post.Really thank you! Keep writing.

Here is a complete guide to watch Summer Olympics 2021 live online from anywhere without cable. Stream Tokyo 2020 Olympics Table Tennis from home.

Hey There. I found your blog using msn. This is a very well written article.I will be sure to bookmark it and return to read more ofyour useful info. Thanks for the post. I will certainly return.

I appreciate you sharing this blog.Really thank you! Want more.

An intriguing discussion is worth comment. There’s no doubt that that you should write more about this topic, it may not be a taboo subject but generally people do not talk about such topics. To the next! Kind regards!!

continuously i used to read smaller articles or reviews which as well clear their motive, and that is also happening with this paragraph which I am reading here.

I really enjoy the blog.Really thank you! Will read on…

Everyone loves what you guys are up too. This kind of clever work and coverage! Keep up the excellent works guys I’ve incorporated you guys to my own blogroll.

I think this is a real great article.Really thank you! Awesome.

Very neat article.Much thanks again. Much obliged.

overseas pharmacies shipping to usa india pharmacies shipping to usa – overseas pharmacies shipping to usa

Thanks so much for the article post.Much thanks again. Cool.

Thanks-a-mundo for the blog post.Much thanks again. Cool.

I blog often and I genuinely thank you for your information. The article has really peaked my interest. I’m going to take a note of your blog and keep checking for new details about once per week. I subscribed to your RSS feed as well.

Thank you ever so for you article post.Really thank you! Really Cool.

I am so grateful for your blog article. Much obliged.

I value the post.Really looking forward to read more. Keep writing.

Thank you, I’ve just been looking for info approximately this topic for a while and yours is the best I’ve came upon so far. But, what about the bottom line? Are you certain in regards to the supply?

Major thankies for the blog article.Much thanks again. Fantastic.

Aw, this was an exceptionally good post. Finding the time and actual effort to create a really good articleÖ but what can I sayÖ I put things off a whole lot and never seem to get anything done.

Wow, great post.Thanks Again. Really Great.

Thanks-a-mundo for the blog article.Much thanks again. Fantastic.

Enjoyed every bit of your blog article.Really looking forward to read more. Really Cool.

Thanks-a-mundo for the blog post.

865562 208838Exceptional post nevertheless , I was wanting to know if you could write a litte a lot more on this topic? Id be really thankful should you could elaborate a little bit much more. Thanks! 10034

Thanks a lot for the blog post. Much obliged.

Thanks again for the article.Really thank you! Want more.

I don’t even know how I ended up here, but I thought this post was great. I do not know who you are but definitely you are going to a famous blogger if you are not already 😉 Cheers!

Great, thanks for sharing this article post.Really looking forward to read more. Cool.

Great post.Thanks Again. Cool.

At this time I am going away to do my breakfast, once having my breakfast coming again to read additional news.Look at my blog :: hcg injections online

Looking forward to reading more. Great article.Really looking forward to read more. Fantastic.

Major thanks for the blog.Thanks Again. Cool.

washington state says:bookmarked!!, I love your blog!Reply 08/18/2020 at 8:49 am

A big thank you for your article.Thanks Again. Want more.

I value the article post.Thanks Again. Keep writing.

Muchos Gracias for your blog.Really looking forward to read more. Great.

I am so grateful for your article.Really thank you!

Really enjoyed this blog post, can you make it so I get an update sent in an email whenever you publish a new post?

Really appreciate you sharing this article post.

İnstagram takipçi satın al .. Takipçi satın al ve İnstagram takipçi satın al!

Terrific post but I was wanting to know if you could write a littemore on this subject? I’d be very grateful if you could elaborate a little bitfurther. Kudos!

Enjoyed every bit of your blog post.Thanks Again. Fantastic.

Turoffnung Appenhofen, Tresoroffnung Appenhofen, Schlie?zylinder wechsel AppenhofenSchlusseldienst Appenhofen Schlusseldienst Leistungen Appenhofen Schlusseldienst Appenhofen

Thank you for your blog article.Really thank you! Cool.

I really liked your blog post.Really looking forward to read more. Really Great.

Thanks again for the post.Really thank you! Will read on…

Very informative post.Thanks Again. Really Great.

I cannot thank you enough for the blog post.Much thanks again. Really Cool.

I loved your article post. Will read on…

Really appreciate you sharing this blog.Really thank you! Great.

Thank you for your blog article. Cool.

A big thank you for your post.Really looking forward to read more. Great.

Great, thanks for sharing this article post.Thanks Again. Want more.

I cannot thank you enough for the blog.Really looking forward to read more. Much obliged.

A round of applause for your blog.Really looking forward to read more. Keep writing.

Awesome blog post.Much thanks again. Much obliged.

Very good blog.Really looking forward to read more. Cool.

Very neat blog post.Really thank you! Fantastic.

Really appreciate you sharing this article.Much thanks again. Will read on…

Say, you got a nice article.Thanks Again. Much obliged.

Appreciate you sharing, great blog article.Really thank you! Keep writing.

I appreciate you sharing this blog post.Really thank you! Will read on…

Muchos Gracias for your article.Much thanks again. Really Great.

Great, thanks for sharing this blog.Really looking forward to read more. Fantastic.

Hello! I could have sworn Iíve been to this blog before but after going through a few of the posts I realized itís new to me. Anyways, Iím definitely happy I stumbled upon it and Iíll be bookmarking it and checking back often!

herbal equivalent to ivermectin ivermectin tapeworms

Enjoyed every bit of your post.Thanks Again. Much obliged.

Biodegradable Plastic Plant Potsブランドコピー代引き10HP Water-cooled Box Chiller

Wow that was unusual. I just wrote an incredibly long comment but after I clicked submit my comment didn’t appear. Grrrr… well I’m not writing all that over again. Anyhow, just wanted to say excellent blog!

A big thank you for your blog post.Thanks Again. Really Cool.

This is one awesome blog.Thanks Again. Awesome.

canadian sildenafil – natural sildenafil sildenafil online canada

Really informative blog article.Really thank you! Will read on…

I like what you guys tend to be up too. This kind of clever workand exposure! Keep up the good works guys I’veincorporated you guys to my own blogroll.

Aw, this was an incredibly good post. Spending some time andactual effort to generate a great article… but what can Isay… I put things off a lot and don’t seem to get nearly anything done.

Looking forward to reading more. Great article post.Thanks Again.

Wow, great blog post.Really thank you! Much obliged.

Aw, this was a really nice post. Taking the time and actual effort to generate a very good article… but what can I say… I put things off a whole lot and don’t seem to get nearly anything done.

Hello there! This is my first visit to your blog! We are a team of volunteers and starting a new initiative in a community in the same niche. Your blog provided us valuable information to work on. You have done a extraordinary job!

Really appreciate you sharing this blog post.Much thanks again. Want more.

Im obliged for the blog.Much thanks again. Fantastic.

stromectol for sale ivermectin for humans for sale – stromectol order online

The office building where I work is quite stingy, they turn off the main lights and electricity after six o’clock in the afternoon. d

I quite like looking through an article that will make people think.Also, thank you for permitting me to comment!

Piece of writing writing is also a fun, if you know after that you can write if not it is complicated towrite.

Thanks a lot for the article post. Much obliged.

There is noticeably a bundle to know about this. I assume you produced particular nice points in attributes also.

I am now not certain the place you’re getting your information, however great topic. I needs to spend some time studying much more or working out more. Thanks for magnificent information I used to be in search of this information for my mission.

Really appreciate you sharing this blog article.Really thank you! Much obliged.

Very good blog post.Much thanks again. Awesome.

Im obliged for the blog.Really looking forward to read more.

I cannot thank you enough for the post.Much thanks again. Keep writing.

Thank you for your post.Really looking forward to read more. Will read on…

I truly appreciate this article post.Thanks Again. Fantastic.

Great blog.Really thank you! Will read on…

Bardzo interesujący temat, dzięki za wysłanie wiadomości plastry na opryszczkę.!!!Loading…

Thanks , I’ve recently been searching for info approximately this subject for a long time and yours is the greatest I have discovered so far. But, what concerning the conclusion? Are you sure in regards to the source?

I think this is a real great article.Really looking forward to read more. Keep writing.

Hi friends, іtѕ enorous paragraph concerning сultureeand completely defined, keepit up all the time.Feel free to visit my blоg; poker online terpercaya

Thanks again for the article. Much obliged.

A motivating discussion is definitely worth comment. I believe that you need to write more on this topic, it may not be a taboo subject but usually people do not talk about such issues. To the next! Kind regards!!

Thanks for sharing, this is a fantastic post.Really thank you! Cool.

Thanks in support of sharing such a pleasant opinion, piece of writing is pleasant, thats why i have read it completely

I really like and appreciate your article post. Great.

what does essay mean in spanishcause and effect essay exampleshow to write a collage essay

I’m now not certain the place you’re getting your info, but good topic.I must spend some time finding out much more orfiguring out more. Thank you for great info I used to be in searchof this information for my mission.

Really appreciate you sharing this blog article.Much thanks again. Want more.

I do consider all the ideas you have introduced on your post. They are very convincing and can definitely work. Still, the posts are very brief for starters. May just you please prolong them a little from next time? Thank you for the post.

play slots online online slot games slots for real money

Very neat article post.Much thanks again. Awesome.

Fantastic article.Really thank you! Awesome.

natural help for ed ed medication online – herbal ed treatment

Thank you for your blog post.Really looking forward to read more. Awesome.

Hello there, just became alert tto your blog through Google,and found that it iis ttuly informative. I am gonna watchoout for brussels. I’ll be grateful iif you cokntinue this in future.Lots of people will be benefited from your writing.Cheers!

I want to to thank you for this excellent read!! I certainly enjoyed every little bit of it. I have got you book-marked to look at new stuff you postÖ

I really liked your blog.Thanks Again. Will read on…

What’s Happening i am new to this, I stumbled upon this I’ve discovered It positivelyhelpful and it has helped me out loads. I am hoping togive a contribution & assist other customers like its aidedme. Good job. pof natalielise

This paragraph provides clear idea for the new users of blogging, that really how to do running a blog.

I value the post. Fantastic.

Thank you ever so for you blog article.Thanks Again. Awesome.

hydrochlorothiazide 50 hydrochlorothiazide potassium hydrochlorothiazide 50

I don’t even know how I ended up here, but I thought this post was good. I do not know who you are but certainly you are going to a famous blogger if you are not already 😉 Cheers!

Very neat article.Really thank you! Really Great.

Muchos Gracias for your article post.Thanks Again.

Thanks so much for the post.Really thank you! Fantastic.

Muchos Gracias for your post.Really thank you! Much obliged.

Enjoyed every bit of your blog.Really looking forward to read more.

canadian pharmacy sildenafil – pluspharmus.com canadian pharmacy world reviews

Now im so in love with this url , it aids me so much with foregathering excellent info about how to look after myself.

Entendi mais sobre o tema . Obrigado e parabénspor nos mostrar mais sobre isso.

whoah this blog is great i love reading your articles. Keep up the good work! You know, lots of people are searching around for this information, you can aid them greatly.

ehternet cables are still the ones that i use for my home networking applications..

Im thankful for the article post.Really thank you!

It’s hard to seek out educated individuals on this topic, however you sound like you understand what you’re speaking about! Thanks

Joe Turner The Boss Of The Blues Sings Kansas City Jazz Frankie Goes To Hollywood Two Tribes Marilyn Manson The Pale Emperor

Very good info. Lucky me I came across your blog by chance (stumbleupon).I have book-marked it for later!

Thanks-a-mundo for the blog.Really thank you! Really Great.

Very neat blog article.Really thank you! Much obliged.

Wow, great blog.Much thanks again. Great.

trusted india online pharmacies: trusted india online pharmacies india pharmacies online

wow, awesome article post.Really thank you! Will read on…

Thank you for your article post. Great.

Really appreciate you sharing this blog post.Really thank you! Want more.

Great, thanks for sharing this blog post.Much thanks again. Fantastic.

Thanks so much for the article.Thanks Again. Much obliged.

Really informative article post.Really looking forward to read more. Really Cool.

wow, awesome post.Thanks Again. Want more.

Vous refroidissez mon envie d’aller le voir au cinéma !

ivermectin for people topical ivermectin for cats

I really like it whenever people come together and share opinions.Great blog, continue the good work!

Very good post.Much thanks again. Really Cool.

This will be a terrific blog, would you be interested in doing an interview about just how you developed it? If so e-mail me!Kevin Galstyan

Usually I do not read post on blogs, but I would like to say that this write-up very pressured me to take a look at and do it! Your writing style has been amazed me. Thank you, very nice article.

Hello, just wanted to mention, I liked this blog post. It was helpful. Keep on posting!

slots online play slots slots for real money

Hey There. I found your blog using msn. This is a very well written article. I’ll be sure to bookmark it and come back to read more of your useful info. Thanks for the post. I’ll certainly comeback.

This article is really a pleasant one it assists new net visitors, who are wishing in favor of blogging.

Thanks for the post.Really thank you!

This is my first time go to see at here and i am actually happy toread everthing at one place.

I like what you guys tend to be up too. This sort of clever work and coverage!Keep up the wonderful works guys I’ve you guys to my blogroll.

Thanks-a-mundo for the article post.Really thank you! Cool.Loading…

Very neat article post.Much thanks again. Really Cool.

my best friend essay writing – help with term papers essays writing help

Very good blog. Much obliged.

I’m not sure where you’re getting moisturize your skininformation, but great topic. I needs to spend some time learning much more or understanding more.Thanks for excellent info I was looking for this information for my mission.

I cannot thank you enough for the article post.Much thanks again. Really Cool.

Say, you got a nice article post.Much thanks again. Cool.

This is one awesome article.Thanks Again.

Appreciate you sharing, great blog.Thanks Again. Really Cool.

I think this is a real great post.Much thanks again. Will read on…

Muchos Gracias for your blog.Much thanks again. Will read on…

I truly appreciate this blog article.Really thank you! Really Great.

I never thought about it that way, but it makes sense!Static ISP Proxies perfectly combine the best features of datacenter proxies and residential proxies, with 99.9% uptime.

I value the article.Really thank you! Cool.

I value the post.Thanks Again. Fantastic.

Great post.Much thanks again. Cool.

Thanks for the blog post.Really looking forward to read more. Awesome.

Genel Medikal Ürün kategorisinden alışveriş yaptım. Genel Medikal Ürün ürünleri kaliteli, hızlı kargolu ve kullanışlı. Tavsiye ederim.

Serum Lastikleri kategorisinden alışveriş yaptım. Serum Lastikleri ürünleri kaliteli, hızlı kargolu ve kullanışlı. Tavsiye ederim.

Chaos at Kabul airport as Taliban take over capital..nkoa 8/16/2021

I don?t even know how I ended up here, but I thought this post was great. I don’t know who you are but certainly you’re going to a famous blogger if you aren’t already 😉 Cheers!

Very interesting subject , thanks for posting . “The maxim of the British people is ‘Business as Usual.'” by Sir Winston Leonard Spenser Churchill.

It’s actually a cool and useful piece of information. I am satisfied that you just shared this helpful info with us. Please stay us up to date like this. Thanks for sharing.

Really enjoyed this post.Much thanks again. Fantastic.

cedar point apartments sonceto apartments las mananitas apartments

I’d personally love to be some sort of part of group in which I can get guidance from all other experienced people that will share exactly the same interest. In case you have any tips, please let me understand. Thank you.

I am incessantly thought about this, thankyou for posting.

What’s up, its nice piece of writing concerning media print, we allbe aware of media is a wonderful source of data.

This is a topic which is near to my heart… Take care! Where are your contact detailsthough?

Thank you for your article. Fantastic.

Hi there! Would you mind if I share your blog with my twitter group? There’s a lot of folks that I think would really enjoy your content. Please let me know. Cheers

Aw, this was a really good post. Taking the time and actual effort to produce agood article… but what can I say… I hesitate a lot and nevermanage to get anything done.

Hey! This is my first visit to your blog! We are a collection of volunteers and starting a new project in a community in thesame niche. Your blog provided us valuable information to work on.You have done a outstanding job!

ivermectin canada

rolex replica is without a doubt of fine high-quality.

This was an awesome share. Thank you for creating it. I’ll be back t o read some more.

You explained it superbly!admission essay help essays writers ghostwriter needed

for a few hours, then PS4 than a thousands and certainly e

ivermectin dosage for covid worming sheep with ivermectin

I needed to thank you for this fantastic read!! I certainly enjoyed every little bit of it. I have got you bookmarked to look at new stuff you post…

wow, awesome blog.Really looking forward to read more. Really Great.Loading…

I enjoy, lead to I found exactly what I used to be looking for.You have ended my four day long hunt! God Bless you man. Havea nice day. Bye

Thanks-a-mundo for the blog post.Really looking forward to read more. Really Great.

Aw, this was an incredibly nice post. Finding the time and actual effort to create a top notch article… but what can I say… I hesitate a whole lot and never manage to get anything done.

Im obliged for the article post.Much thanks again. Really Great.Loading…