The UK Financial Conduct Authority (FCA) and the Practitioner Panel have published a report from their 2021 joint survey of FCA regulated firms. The survey gives views across the financial services sector of the FCA performance as a regulator.

The respondents were very critical of the time the regulator needs to process authorization applications.

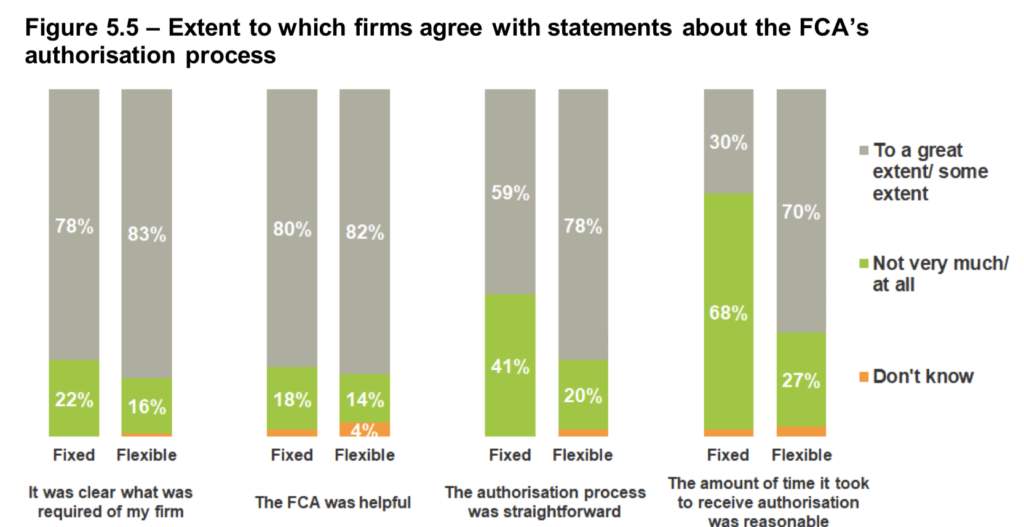

Among firms that had experience of the FCA’s authorisation process in the last 12 months, fixed portfolio firms were most likely to feel that the FCA was helpful (80%) and that it was clear what was required of their firm (78%). However, they were less positive about other aspects of the authorisation process.

Fixed firms were particularly negative about the time taken to receive authorisation: only 30% of fixed firms felt the amount of time taken to receive authorisation was reasonable but more than twice as many (68%) did not think the amount of time taken was reasonable.

Flexible portfolio firms were generally positive about their experience of the authorisation process.

Seven in ten fixed firms (68%) and three quarters of flexible firms (75%) felt, at least to some extent, that the authorisation process prevented firms or individuals who are engaged in poor business practices from entering the industry.

Among firms that did not feel this way, the two most common suggestions for improvement were that the FCA should conduct more due diligence checks on firms as part of the authorisation process and that the FCA should do more to prevent owners or directors of failed firms from re-entering the market (‘phoenixing’).

This is not the first time the FCA gets such feedback over the time it takes to process authorization applications. The regulator has recently published the responses to unanswered questions from its Annual Public Meeting 2021. The list of such questions includes one concerning the slow processing of retail broker license applications.

The question is:

“We see that obtaining licenses for trading companies that are working with retail investors are pretty tough. The whole process takes 1-5 years. Is there any chance it could be faster?”

In response, the FCA explained that it has service standards in place, which it measures itself against and reports on its website. Complete applications should be decided within 6 months, which the regulator achieved for 98.7% of applications in 2020/21. Incomplete applications should be determined within 12 months.

However, according to the regulator, many of the applications it receives are incomplete.

Epic quests, powerful heroes, endless fun! Lucky cola

Gaming goals Achieve greatness, one level at a time Lodibet

Çankaya’da gerçek bir deneyim yaşamak istiyorsanız bu siteyi mutlaka değerlendirin. Her profilde özen ve profesyonellik var.

Aradığım her şeyi bu sitede buldum. Hem görsel kalite hem iletişim açısından çok başarılılar. Ankara escort arayanlara öneririm.