forex broker in South Africa

Meaning of Forex Brokers

Forex brokers are the connecting link between the trader and the foreign exchange market. They receive the trader’s orders and execute them at the market. Without a broker, it will be difficult for traders to participate in forex trading from the comfort of their homes. Hence, they will need to go to the exchange market to do so themselves.

Important factors to consider while choosing a forex broker in South Africa 2023

Regulation: When a broker is duly registered with the regulatory authorities, it gives traders the confidence that their funds are safe with such brokers as their activities are monitored by these regulatory authorities. Each country has got their regulatory authority to monitor the activities of brokers within the region. The most important consideration to make while choosing a broker in South Africa today is to ensure that they are registered with the Financial Sector Conduct Authority (FSCA) and any other major regulators.

Years of experience: Brokers with at least four years of experience in rendering financial services are the best to choose for trading.

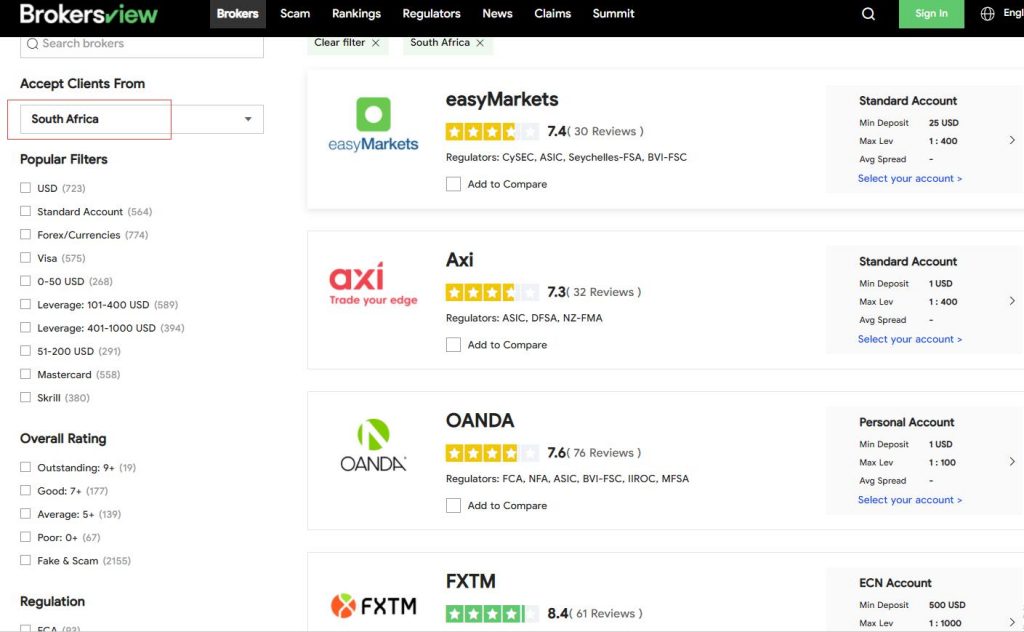

General Review: The general comments from traders who have used the broker’s platform for trading in the past are an important way of deciding a good broker. A review of all forex brokers operating in South Africa is also provided on the brokersview website to guide traders in choosing the best brokers for trading.

Methods of deposit and withdrawals: It is always very necessary for brokers to provide multiple options for deposits and withdrawals to make it easy for traders to do so always.

Customer support: A good broker is usually known for their readiness to listen to clients’ complaints and solve them immediately. Brokers with efficient customer support service are always the best for trading.

Range of financial instruments offered: Brokers are expected to provide a wide range of financial instruments for trading on their platforms. This will help traders to diversify their portfolios and also gain wider exposure to the financial market.

Commissions charged for trading: Brokers with high spread and commissions for trading are usually discouraged for trading; as they reduce the trader’s profits.

Educational and Research materials: To help traders gain wider exposure to the financial market, brokers are expected to provide educational contents on their platforms, including the latest market news to guide traders while trading. This is an important characteristic of a good broker today.