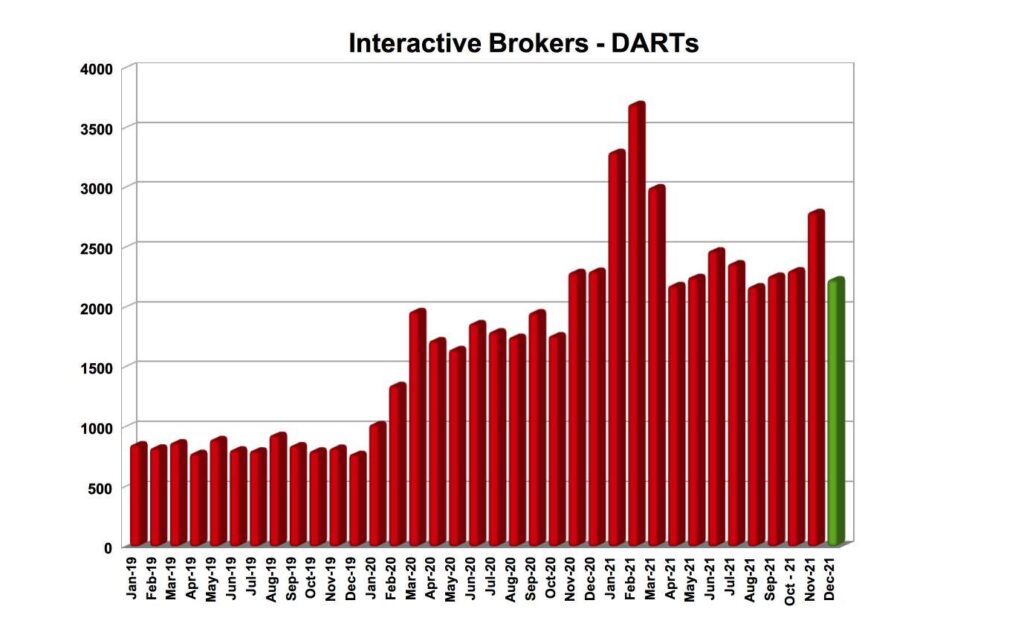

Online trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has just published its key operating metrics for December 2021, with trading volumes down in both annual and monthly terms.

Interactive Brokers reported 2.229 million Daily Average Revenue Trades (DARTs), 3% lower than prior year and 20% lower than prior month, when DARTs were 2.793 million.

Ending client equity amounted to $373.8 billion in December 2021, 30% higher than prior year and about even with the level registered in November 2021. Ending client margin loan balances reached $54.6 billion last month, 40% higher than prior year and about even with prior month.

The number of client accounts was 1.68 million in December 2021, 56% higher than prior year and 2% higher than prior month.

Regarding Interactive Brokers’ performance, let’s note that the broker reported diluted earnings per share of $0.43 for the third quarter of 2021 compared to $0.58 for the equivalent period in 2020, and adjusted diluted earnings per share of $0.78 for this quarter compared to $0.53 for the year-ago quarter.

Net revenues were $464 million in the third quarter of 2021, down from $548 million a year earlier.

Income before income taxes was $234 million for the third quarter of 2021, compared to $334 million for the same period in 2020.

Commission revenue increased $32 million, or 11%, from the year-ago quarter on the back of higher customer stock and options trading volumes.

Net interest income increased $79 million, or 41%, from the year-ago quarter thanks to higher margin loan balances and strong securities lending activity.

Dear immortals, I need some wow gold inspiration to create.

guodi-tech.net Gas Compressor guodi-tech.net.

Ver el contenido del escritorio y el historial del navegador de la computadora de otra persona es más fácil que nunca, solo instale el software keylogger. https://www.xtmove.com/es/how-do-keyloggers-secretly-intercept-information-from-phones/

Discover new worlds and epic challenges! Lucky cola

Greenpark, Oran ve Çukurambar gibi bölgelerde escort arıyorsanız kesinlikle buraya göz atın. Kalite, konfor ve gizlilik bir arada.

Günümüzde kaliteli hizmet bulmak zor. Ancak AnkaraRusModel bu konuda fark yaratıyor. Özellikle Çankaya escort kısmı şahane.

İlk görüşmeden itibaren kendimi özel hissettiren nadir deneyimlerden biri oldu. Özellikle Çankaya escort kızlar çok kibar ve bakımlıydı.

Çankaya merkezli escort arayanlara kesinlikle öneririm. Kalitenin adresi.

Çankaya Escort kategorisindeki çeşitlilik ve kalite gerçekten çok etkileyici. En doğru seçim!

VIP hizmet arayanlar için Ankara Escort kısmı tam anlamıyla biçilmiş kaftan.

покупка аккаунтов https://marketplace-akkauntov-top.ru/

маркетплейс для реселлеров маркетплейс аккаунтов

магазин аккаунтов социальных сетей заработок на аккаунтах

маркетплейс аккаунтов маркетплейс аккаунтов соцсетей

маркетплейс для реселлеров https://pokupka-akkauntov-online.ru

Find Accounts for Sale Account Trading

Verified Accounts for Sale Account market

Sell Pre-made Account Sell accounts

Online Account Store buyaccountsmarketplace.com

Guaranteed Accounts Account Store

Website for Buying Accounts Social media account marketplace

Account Buying Platform Buy Pre-made Account

Sell Pre-made Account Gaming account marketplace

Secure Account Purchasing Platform https://buyaccounts001.com/

Accounts market Account Selling Platform

secure account sales https://cheapaccountsmarket.com

website for selling accounts secure account sales

account buying service purchase ready-made accounts

account acquisition guaranteed accounts

online account store https://accountsmarketbest.com

secure account purchasing platform account market

account selling platform marketplace for ready-made accounts

account purchase account selling service

account trading platform account trading

online account store account exchange

website for buying accounts profitable account sales

buy account account market

sell accounts verified accounts for sale

buy account https://best-social-accounts.org

buy accounts marketplace-social-accounts.org

account selling platform accounts-market-soc.org

account trading platform sell accounts

account exchange account marketplace

account purchase https://accounts-offer.org

account trading https://accounts-marketplace.xyz

sell pre-made account https://buy-best-accounts.org/

account trading service https://social-accounts-marketplaces.live/

profitable account sales https://buy-accounts.space

social media account marketplace account marketplace

account purchase https://buy-accounts.live

website for selling accounts account market

website for buying accounts https://accounts-marketplace.online

account purchase https://accounts-marketplace-best.pro/

покупка аккаунтов маркетплейсов аккаунтов

биржа аккаунтов https://akkaunty-market.live/

биржа аккаунтов https://kupit-akkaunty-market.xyz/

магазин аккаунтов https://online-akkaunty-magazin.xyz/

маркетплейс аккаунтов https://akkaunty-dlya-prodazhi.pro

покупка аккаунтов kupit-akkaunt.online

facebook ad accounts for sale buying facebook account

buy a facebook ad account https://buy-ad-accounts.click/

buy ad account facebook buy facebook ads manager

buy facebook ads manager https://buy-ads-account.click

buy aged fb account https://buy-ads-account.work/

buy account facebook ads https://buy-ad-account.click

buying fb accounts https://ad-accounts-for-sale.work

google ads agency accounts https://buy-ads-account.top

google ads agency accounts buy-ads-accounts.click

buying facebook account buying facebook account

buy google ads invoice account google ads accounts for sale

sell google ads account https://buy-ads-invoice-account.top

google ads agency account buy https://buy-account-ads.work

buy google ads threshold account https://buy-ads-agency-account.top

buy google ads threshold account https://sell-ads-account.click

google ads reseller https://ads-agency-account-buy.click

buy verified facebook business manager account https://buy-business-manager.org

buy google ad threshold account https://buy-verified-ads-account.work

buy fb business manager https://buy-bm-account.org/

facebook business manager account buy https://buy-business-manager-acc.org/

buy facebook bm account https://buy-verified-business-manager.org/

facebook business manager buy buy-business-manager-verified.org

buy verified business manager https://buy-bm.org/

facebook business account for sale https://verified-business-manager-for-sale.org/

buy verified facebook business manager account https://buy-business-manager-accounts.org

tiktok ads account buy tiktok ads agency account

buy tiktok ads https://tiktok-ads-account-buy.org

buy tiktok business account https://buy-tiktok-ads-accounts.org

tiktok ads account for sale https://buy-tiktok-business-account.org

tiktok agency account for sale https://buy-tiktok-ads.org

Explore the ranked best online casinos of 2025. Compare bonuses, game selections, and trustworthiness of top platforms for secure and rewarding gameplaycasino.

Anatomik Modeller kategorisinden alışveriş yaptım. Anatomik Modeller ürünleri kaliteli, hızlı kargolu ve kullanışlı. Tavsiye ederim.

Tıbbi Atık Kutuları kategorisinden alışveriş yaptım. Tıbbi Atık Kutuları ürünleri kaliteli, hızlı kargolu ve kullanışlı. Tavsiye ederim.

Ateş Ölçerler/Termometreler kategorisinden alışveriş yaptım. Ateş Ölçerler/Termometreler ürünleri kaliteli, hızlı kargolu ve kullanışlı. Tavsiye ederim.

buy account facebook ads social media account marketplace account market

buy fb ads account secure account purchasing platform buy and sell accounts