Online trading company Plus500 Ltd (LON:PLUS) today posted its results for the six month period ended 30 June 2021. Although earnings marked a drop compared to the year-ago period, the broker notes that its financial performance in H1 2021 compares very strongly to the performance in the pre-pandemic environment of H1 2019.

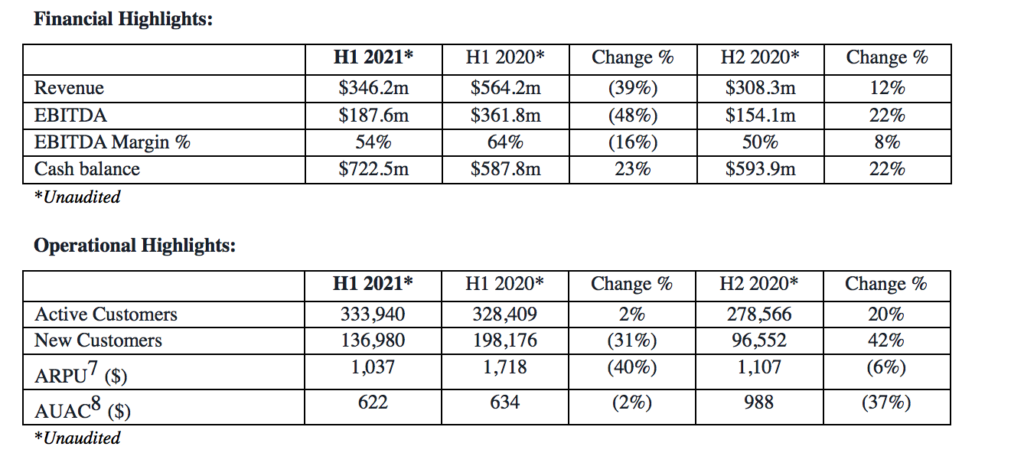

During the first half of 2021, the Group generated total revenue of $346.2 million, down from $564.2 million, generated in the year-ago period.

EBITDA for H1 2021 was $187.6 million, down from $361.8 million registered in the first half of 2020.

Net profit in H1 2021 was $165.1 million, compared to $320.0 million registered in the equivalent period in 2020.

In terms of customer acquisition, Plus500 onboarded a total of 136,980 New Customers in H1 2021 (H1 2020: 198,176, H2 2020: 96,552), including 47,574 in Q2 2021 (Q2 2020: 115,225). This compares to 91,388 New Customers on-boarded in the pre-pandemic environment of FY 2019.

Average revenue per user was slightly changed from a year earlier at $1,037 in H1 2021 (H1 2020: $1,718), including $683 in Q2 2021 (Q2 2020: $936).

Average user acquisition cost was $622 in H1 2021 (H1 2020: $634), including $903 in Q2 2021 (Q2 2020: $634), supported by high levels of historic marketing technology investment, advanced marketing technologies employed by the Company during the period and Plus500’s continued strong brand presence.

While AUAC is relatively low, compared to historic periods, Plus500 expects it to rise steadily over time, as previously highlighted, as the Group’s customer profile continues to shift to higher value customers and as Plus500 starts to invest in attracting customers to the new products in its portfolio, in particular futures and share dealing, as well as targeting customers in strategic geographies.

Regarding strategic moves in 2021, let’s note that the completion of the acquisition in the US of Cunningham, a regulated Futures Commission Merchant, and CTS, a technology trading platform provider, originally announced in April 2021.

This acquisition represents a major growth opportunity for Plus500, by instantly expanding its geographic footprint and product offering in the significantly growing, but under-penetrated, US retail trading market in futures and options on futures, with the global addressable market estimated to be approximately $2 billion.

The acquisition, for which integration is already underway, enables Plus500 to leverage its best-in-class technology to drive market access for the millions of potential US customers looking for new trading opportunities, through a wide range of asset classes.

Another major milestone in executing against this vision was also achieved in July 2021 with the launch of ‘Plus500 Invest‘, the company’s new share dealing platform, initially in selected geographies in Europe and across a number of product offerings, including a wide range of financial instruments comprising of the world’s most popular equities and ETFs, listed on major exchanges worldwide. Plus500 will continue rolling out ‘Plus500 Invest’, to ensure the further expansion of the Group’s product range and geographic footprint, and to provide customers with additional product optionality.

Muchas gracias. ?Como puedo iniciar sesion?

Play now and discover the excitement of online gaming Lodibet

İlk defa bir escort sitesinde bu kadar detaylı ve kullanıcı dostu filtreleme gördüm. Ankara escort kategorisindeki çeşitlilik çok etkileyici.

Özellikle öğrenci ve olgun escort kategorilerinde oldukça geniş bir portföy sunuyorlar. Çankaya’da tercih edilecek tek adres.

İyi ki denk gelmişim dediğim bir site. Aradığım zarafet ve sınıf buradaydı. Özellikle Çankaya escort profilleri çok seçkin.

Ankara’da güvenle tercih edilebilecek ender platformlardan biri. Özellikle Çankaya Escort bölümü kusursuz.

Her profilde özen ve kaliteyi görmek mümkün. Ankara Escort sektöründe gerçekten fark yaratıyorlar.

Explore the ranked best online casinos of 2025. Compare bonuses, game selections, and trustworthiness of top platforms for secure and rewarding gameplaycrypto casino.

Diyabet Ürünleri kategorisinden alışveriş yaptım. Diyabet Ürünleri ürünleri kaliteli, hızlı kargolu ve kullanışlı. Tavsiye ederim.