Multi-asset investment company Saxo Bank announces that its equity theme baskets will undergo a yearly review in January and some of the baskets will likely see changes.

Saxo still has the robotics & automation theme in the pipeline, but it has proved to be more difficult to isolate in terms of pure exposure and risk drivers, but Saxo expects it to be published in 2022.

In light of the ESG trend, Saxo is planning a Women leadership basket which will focus on companies with a share of women in the leadership and board of directors. This basket is in the pipeline to provide investors with a set of companies that diverges significantly on the gender leadership issue and thus represent a change in society.

The energy crisis centered around supplies of natural gas has evolved into a fertilizer production crisis with soaring prices which will impact food prices next year. Saxo will launch a food basket which will consists of vertical farming, animal producers, seeds producers, sugar and coffee producers and distributors, farming equipment. This basket will have some overlap with the commodity basket but will be much more narrow.

In 2021 the electric vehicles industry matured a lot of more pure EV producers became publicly listed including charging station providers. This means that Saxo will expand the battery basket to include EV-makers and charging stations which will make this theme basket much better. The criteria for traditional carmakers to be added to this basket is to have more than 50% of revenue coming from battery electric vehicles.

Saxo is considering as part of this change to pull out electric vehicles from the green transformation basket and rename that to renewable energy. The potentially updated renewable energy basket will focus on solar, wind, hydrogen, hydro, bioplastic, and copper.

Let’s recall that in January Saxo launched its new equity research framework centered around equity theme baskets. It started with its ommodity basket comprising of agriculture, energy, chemicals, and metals and mining companies. Saxo’s premise has from the start been that the baskets should represent pure exposure to the theme, less covered by a well-designed ETF, represent a long-term trend, and become Saxo’s lens to understand the underlying dynamics in the equity market. classifications or country indices by MSCI Inc.

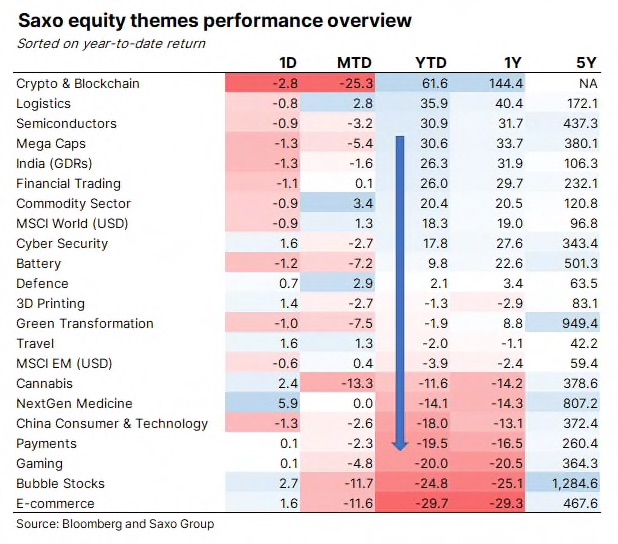

Regarding the performance of its equity theme baskets in 2021, Saxo’s Head of Equity Strategy Peter Garnry comments:

“This year has been very exciting with incredible divergence inside the equity market. At the bottom themes such as Gaming, Bubble, and E-commerce stocks are down 20%, 25% and 30% respectively as these stocks have been hit by lower revenue expectations and higher interest rates this year with weakness likely to continue next year as long-term interest rates will be forced close some of the gap to inflation.

The three best performing themes this year, Crypto & Blockchain (+62%), Logistics (+36%) , and Semiconductors (+31%), are quite telling of the year we have been through”.

I truly appreciate your technique of writing a blog. I added it to my bookmark site list and will

VIP seviyesinde bir hizmet aldım. Özellikle Çankaya escort modelleri kendini çok belli ediyor. Teşekkürler AnkaraRusModel.

İlk görüşmeden itibaren kendimi özel hissettiren nadir deneyimlerden biri oldu. Özellikle Çankaya escort kızlar çok kibar ve bakımlıydı.

Yenimahalle, Etlik, Sincan gibi merkez dışı bölgelerde bile kaliteli escort profilleri görmek şaşırtıcıydı. Ankara escort ağını iyi kurmuşlar.

перепродажа аккаунтов маркетплейс для реселлеров

купить аккаунт с прокачкой https://marketplace-akkauntov-top.ru/

купить аккаунт магазин аккаунтов

услуги по продаже аккаунтов https://ploshadka-prodazha-akkauntov.ru/

магазин аккаунтов маркетплейс аккаунтов

маркетплейс аккаунтов соцсетей https://kupit-akkaunt-top.ru/

маркетплейс аккаунтов покупка аккаунтов

Buy and Sell Accounts Account trading platform

Secure Account Sales Buy Pre-made Account

Website for Buying Accounts Account Market

Account Store Accounts market

Account Market Accounts market

Buy and Sell Accounts Find Accounts for Sale

Account Buying Service Account trading platform

Account Catalog Account Buying Service

Account Store Account marketplace

Account Market Online Account Store

sell accounts buy pre-made account

account selling platform sell account

account exchange service sell pre-made account

ready-made accounts for sale account market

accounts market gaming account marketplace

guaranteed accounts buy accounts

buy accounts account exchange

account catalog buy and sell accounts

account selling platform account selling platform

account store sell pre-made account

accounts market marketplace for ready-made accounts

account trading service accounts market

secure account purchasing platform account purchase

buy pre-made account https://accounts-for-sale.org

accounts for sale gaming account marketplace

online account store guaranteed accounts

account store account marketplace

account acquisition account exchange service

account trading platform sell account

account selling service database of accounts for sale

account acquisition guaranteed accounts

account trading service account trading

sell accounts account selling platform

account trading service account selling platform

buy account https://accounts-store.org

secure account sales purchase ready-made accounts

account catalog buy accounts

accounts market https://accounts-offer.org

sell accounts account market

account trading platform https://social-accounts-marketplaces.live

account trading service accounts market

online account store accounts marketplace

social media account marketplace buy accounts

account selling service https://buy-accounts-shop.pro/

secure account sales https://buy-accounts.live/

account trading https://accounts-marketplace.online/

find accounts for sale https://social-accounts-marketplace.live/

account trading platform https://accounts-marketplace-best.pro

площадка для продажи аккаунтов https://akkaunty-na-prodazhu.pro

площадка для продажи аккаунтов https://rynok-akkauntov.top

купить аккаунт https://kupit-akkaunt.xyz/

маркетплейс аккаунтов https://akkaunt-magazin.online

покупка аккаунтов https://akkaunty-market.live

маркетплейс аккаунтов соцсетей https://kupit-akkaunty-market.xyz

биржа аккаунтов https://akkaunty-optom.live

магазин аккаунтов online-akkaunty-magazin.xyz

маркетплейс аккаунтов https://akkaunty-dlya-prodazhi.pro

маркетплейс аккаунтов магазины аккаунтов

facebook ads accounts https://buy-adsaccounts.work/

buy facebook account https://buy-ad-accounts.click

buy facebook advertising accounts facebook ad account buy

buy facebook account for ads buy-ads-account.click

facebook ads account for sale https://ad-account-buy.top

buy facebook ads manager https://buy-ads-account.work

facebook ad accounts for sale cheap facebook advertising account

Эта информационная статья охватывает широкий спектр актуальных тем и вопросов. Мы стремимся осветить ключевые факты и события с ясностью и простотой, чтобы каждый читатель мог извлечь из нее полезные знания и полезные инсайты.

Изучить вопрос глубже – https://medalkoblog.ru/

buy accounts facebook https://buy-ad-account.click

buy aged facebook ads accounts https://ad-accounts-for-sale.work

buy google adwords accounts google ads accounts for sale

buy google ads agency account https://buy-ads-accounts.click

buy fb ad account facebook ad accounts for sale

google ads reseller google ads account for sale

buy verified google ads account https://ads-account-buy.work

buy aged google ads account google ads agency accounts

buy aged google ads account https://buy-account-ads.work

google ads agency account buy https://buy-ads-agency-account.top/

buy google ads agency account https://sell-ads-account.click/

buy google agency account ads-agency-account-buy.click

buy verified facebook business manager account buy-business-manager.org

old google ads account for sale https://buy-verified-ads-account.work/

buy verified bm https://buy-bm-account.org/

facebook business manager account buy buy bm facebook

buy business manager facebook https://buy-verified-business-manager.org

buy business manager facebook https://buy-business-manager-acc.org

buy verified business manager https://business-manager-for-sale.org/

buy facebook verified business account https://buy-business-manager-verified.org

buy business manager https://buy-bm.org/

verified business manager for sale https://buy-business-manager-accounts.org/

buy tiktok ads https://buy-tiktok-ads-account.org

buy verified facebook business manager https://verified-business-manager-for-sale.org

buy tiktok ads account https://tiktok-ads-account-buy.org

tiktok ads account buy https://tiktok-ads-account-for-sale.org

buy tiktok ads https://tiktok-agency-account-for-sale.org

tiktok ad accounts https://buy-tiktok-ad-account.org

buy tiktok ads accounts https://buy-tiktok-ads-accounts.org

buy tiktok ads account https://tiktok-ads-agency-account.org

Explore the ranked best online casinos of 2025. Compare bonuses, game selections, and trustworthiness of top platforms for secure and rewarding gameplaycasino activities.

tiktok ads account for sale https://buy-tiktok-business-account.org

buy tiktok ads accounts https://buy-tiktok-ads.org