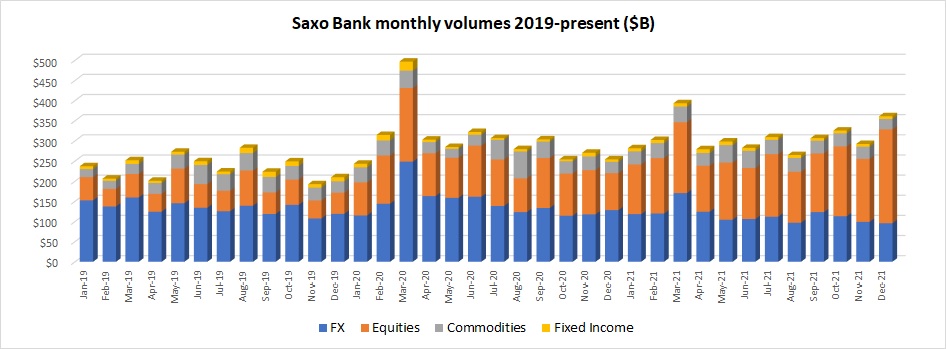

Copenhagen based Retail FX and CFDs broker Saxo Bank closed out a fairly slow 2021 with a strong December showing, with its overall client multi-asset trading volumes coming in at $361 billion – its second best month of the year.

Two thirds of Saxo’s December activity came in the form of equity trading, which was up by 49% MoM to $233 billion. The $233 billion figure was a record for Saxo in terms of equity trading, and its first time surpassing the $200B level. The robust equity activity, as clients looked to take profits in shares and share CFDs before year-end, covered up what was another weak month in Saxo’s other areas including FX trading, with client FX volumes coming in at $95.7 billion – Saxo’s lowest FX trading result in any month since 2015.

In Saxo Bank’s other product areas for December:

- Commodities $25.6 billion, -15%

- Fixed Income $6.8 billion, +0%

Saxo Bank is controlled by Chinese conglomerate Geely Group.

Dear immortals, I need some wow gold inspiration to create.

This is really interesting You re a very skilled blogger. I ve joined your feed and look forward to seeking more of your magnificent post.

Le système Android vous permet de prendre des captures d’écran sans aucun autre logiciel. Mais ceux qui ont besoin de suivre secrètement des captures d’écran à distance ont besoin d’un tracker de capture d’écran spécial installé. https://www.xtmove.com/fr/how-to-get-and-track-screenshots-of-android-phone-remotely/

Customize your hero and embark on a thrilling quest! Lucky cola

Epic quests, powerful heroes, endless fun! Lucky cola

VIP seviyesinde bir hizmet aldım. Özellikle Çankaya escort modelleri kendini çok belli ediyor. Teşekkürler AnkaraRusModel.

VIP seviyesinde bir hizmet aldım. Özellikle Çankaya escort modelleri kendini çok belli ediyor. Teşekkürler AnkaraRusModel.

Greenpark, Oran ve Çukurambar gibi bölgelerde escort arıyorsanız kesinlikle buraya göz atın. Kalite, konfor ve gizlilik bir arada.

Her profilde özen ve kaliteyi görmek mümkün. Ankara Escort sektöründe gerçekten fark yaratıyorlar.

Seçenek fazlalığı ve filtreleme özellikleri sayesinde en doğru Çankaya Escort modeline çok hızlı ulaşabildim. Teşekkürler Ankara Escort Rehberi.

Fiyat-performans açısından değerlendirildiğinde, Ankara Escort arayanlar için en akıllıca seçim burada.

биржа аккаунтов биржа аккаунтов

перепродажа аккаунтов магазин аккаунтов социальных сетей

купить аккаунт с прокачкой купить аккаунт

гарантия при продаже аккаунтов безопасная сделка аккаунтов

платформа для покупки аккаунтов купить аккаунт

платформа для покупки аккаунтов платформа для покупки аккаунтов

гарантия при продаже аккаунтов маркетплейс аккаунтов

Account Buying Platform Account Buying Platform

Sell Pre-made Account https://accountsmarketplacepro.com/

Buy and Sell Accounts Database of Accounts for Sale

Buy and Sell Accounts Buy accounts

Website for Selling Accounts Account Exchange Service

Marketplace for Ready-Made Accounts Secure Account Sales

Buy accounts Database of Accounts for Sale

Account Selling Service Purchase Ready-Made Accounts

Account Selling Platform Ready-Made Accounts for Sale

Account Trading Marketplace for Ready-Made Accounts

guaranteed accounts accounts for sale

purchase ready-made accounts account purchase

sell pre-made account sell pre-made account

account trading account trading platform

database of accounts for sale account trading

account exchange sell pre-made account

verified accounts for sale accounts for sale

account market secure account purchasing platform

account trading service account buying platform

buy accounts account trading

database of accounts for sale guaranteed accounts

secure account purchasing platform accounts-buy.org

buy account gaming account marketplace

account trading platform account market

account acquisition accounts for sale

account trading platform https://buy-social-accounts.org

website for selling accounts account trading platform

ready-made accounts for sale accounts marketplace

verified accounts for sale online account store

accounts for sale secure account sales

sell pre-made account secure account purchasing platform

account exchange service online account store

accounts market https://sale-social-accounts.org/

website for buying accounts account exchange service

database of accounts for sale account selling platform

accounts for sale website for selling accounts

account buying service account trading service

account sale https://accounts-offer.org/

account trading account marketplace

purchase ready-made accounts https://social-accounts-marketplaces.live

buy accounts https://accounts-marketplace.live

account trading https://social-accounts-marketplace.xyz

verified accounts for sale buy-accounts.space

buy and sell accounts https://buy-accounts-shop.pro/

account buying service https://buy-accounts.live

account selling service https://accounts-marketplace.online

website for selling accounts https://social-accounts-marketplace.live/

account market https://accounts-marketplace-best.pro

биржа аккаунтов https://akkaunty-na-prodazhu.pro

маркетплейс аккаунтов https://rynok-akkauntov.top/

магазин аккаунтов https://kupit-akkaunt.xyz

купить аккаунт https://akkaunt-magazin.online/

площадка для продажи аккаунтов akkaunty-market.live

площадка для продажи аккаунтов kupit-akkaunty-market.xyz

биржа аккаунтов akkaunty-optom.live

биржа аккаунтов магазины аккаунтов

магазин аккаунтов akkaunty-dlya-prodazhi.pro

биржа аккаунтов https://kupit-akkaunt.online

buy account facebook ads https://buy-adsaccounts.work/

facebook ads account buy https://buy-ad-accounts.click

cheap facebook account buy old facebook account for ads

cheap facebook accounts https://buy-ads-account.click

buying facebook accounts buy facebook ads accounts

buy ad account facebook buy-ads-account.work

buy facebook profiles buy facebook account

Предлагаем вашему вниманию интересную справочную статью, в которой собраны ключевые моменты и нюансы по актуальным вопросам. Эта информация будет полезна как для профессионалов, так и для тех, кто только начинает изучать тему. Узнайте ответы на важные вопросы и расширьте свои знания!

Выяснить больше – https://medalkoblog.ru/

buy fb account buy old facebook account for ads

buy facebook accounts cheap https://ad-accounts-for-sale.work

google ads account for sale https://buy-ads-account.top

buy google ad threshold account https://buy-ads-accounts.click

facebook ad accounts for sale https://buy-accounts.click

buy aged google ads accounts https://ads-account-for-sale.top

adwords account for sale https://ads-account-buy.work/

buy aged google ads account https://buy-ads-invoice-account.top

adwords account for sale https://buy-account-ads.work

buy aged google ads accounts https://buy-ads-agency-account.top/

buy account google ads buy google agency account

buy google ads verified account https://ads-agency-account-buy.click/

facebook business manager account buy https://buy-business-manager.org/

google ads account seller sell google ads account

buy facebook ads accounts and business managers buy-bm-account.org

buy verified business manager facebook buy-verified-business-manager-account.org

verified bm for sale https://buy-verified-business-manager.org

verified bm buy-business-manager-acc.org

facebook business manager buy business-manager-for-sale.org

verified facebook business manager for sale https://buy-business-manager-verified.org

buy facebook bm buy-bm.org

tiktok ads agency account https://buy-tiktok-ads-account.org

buy facebook business account verified-business-manager-for-sale.org

tiktok ad accounts https://tiktok-ads-account-buy.org

tiktok ads account buy https://tiktok-ads-account-for-sale.org

buy tiktok ads https://tiktok-agency-account-for-sale.org

tiktok ad accounts https://buy-tiktok-ad-account.org

buy tiktok ads accounts https://buy-tiktok-ads-accounts.org

tiktok ads account buy https://tiktok-ads-agency-account.org

tiktok ads account buy https://buy-tiktok-business-account.org

buy tiktok business account tiktok ads account buy

Explore the ranked best online casinos of 2025. Compare bonuses, game selections, and trustworthiness of top platforms for secure and rewarding gameplayBonus offer.

Elastik Bandajlar kategorisinden alışveriş yaptım. Elastik Bandajlar ürünleri kaliteli, hızlı kargolu ve kullanışlı. Tavsiye ederim.

Tıbbi Atık Kutuları kategorisinden alışveriş yaptım. Tıbbi Atık Kutuları ürünleri kaliteli, hızlı kargolu ve kullanışlı. Tavsiye ederim.