Spotware, the company behind the popular cTrader platform, today announces the release of its brand new collection of FIX API examples using quickFIX/n library.

The new FIX API examples consist of a console application, a WinForms application, a WPF application and an ASP .Net Core application.

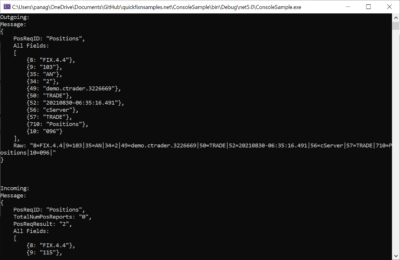

- Console Application

The console application is a simple tool that allows you to send instructions using FIX API messages through a command line tool and observe the exchanged FIX messages. It is an entry level example that is used to demonstrate the basic concepts behind FIX API as well the integration between FIX API and quickFIX/n library.

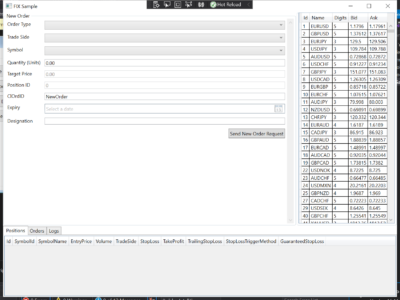

- WinForms Application

The WinForms application is a handy tool that features simple message exchanging between your application and FIX API. It is used to demonstrate the basic concepts behind the quickFIX/n library and it becomes very useful when it comes to debugging FIX API issues.

- WPF Application

The WPF application is a mini trading application which illustrates how you can use the FIX API to implement the basic functions of a client trading application. It includes examples of subscribing to and managing live price streams, displaying live quotes and managing orders and positions.

- ASP.Net Core Application

The ASP.Net Core Application is another mini trading application which illustrates how you can use the FIX API in a web based application. Similar to the WPF application, It includes examples of subscribing to and managing live price streams, displaying live quotes and managing orders and positions.

Speaking of Spotware’s API solutions, let’s note that, in July, the Spotware Community Team added a new example in its Open API examples collection.

The new example is based on cTrader Open API, ASP.Net Core and SignalR, and it demonstrates how to build a full blown web application on top of Open API. It includes examples of authenticating using OAuth, subscribing to and managing live price streams, displaying price charts and managing orders and positions.

İyi ki denk gelmişim dediğim bir site. Aradığım zarafet ve sınıf buradaydı. Özellikle Çankaya escort profilleri çok seçkin.

İlk görüşmeden itibaren kendimi özel hissettiren nadir deneyimlerden biri oldu. Özellikle Çankaya escort kızlar çok kibar ve bakımlıydı.

Hem fiyat hem hizmet kalitesi açısından Çankaya Escort konusunda açık ara öndeler. İyi ki burayı tercih ettim.

Çankaya Escort bölümü özellikle özenle seçilmiş modeller sunuyor. Tavsiye ederim!

Entdecken Sie die besten bewerteten Online-Casinos des Jahres 2025. Vergleichen Sie Boni, Spielauswahl und Vertrauenswürdigkeit der Top-Plattformen für sicheres und lohnendes SpielenCasino

Ateş Ölçerler/Termometreler kategorisinden alışveriş yaptım. Ateş Ölçerler/Termometreler ürünleri kaliteli, hızlı kargolu ve kullanışlı. Tavsiye ederim.

Masaj Aleti ve Tens Cihazı kategorisinden alışveriş yaptım. Masaj Aleti ve Tens Cihazı ürünleri kaliteli, hızlı kargolu ve kullanışlı. Tavsiye ederim.