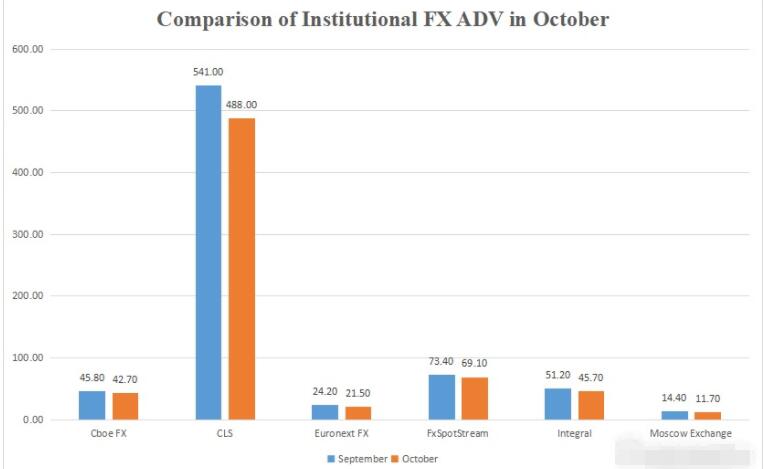

The trading volumes of leading institutional FX and ECN platforms in October 2022 have been revealed, generally showing an overall drop across major markets. So, how did institutional investors and interdealers perform at the over-the-counter markets of the month? Let’s read the data.

The report covers Average Daily Volume (ADV) of institutional FX trading volumes from six major venues, namely Cboe FX, CLS, Euronext FX, FxSpotStream, Moscow Exchange and Integral, as shown in the chart below.

The venues all reported a drop in average daily FX trading volumes in October 2022 versus September. Overall, Moscow Exchange has the biggest percent of MoM decrease of 18.8 percent, followed by Euronext FX and Integral with 11.2 percent and 10.7 percent. CLS,

Cboe FX and FxSpotStream showing a MoM decrease of 9.8 percent, 6.8 percent and

5.9 percent respectively.

Cboe FX

Cboe FX registered a total volume of $854.9 billion, a month-over-month decline of 11.1 percent compared to $1.0083 trillion in September 2022. On a yearly basis, the FX trading demand increased by 24.9 percent from last year’s $717.5 billion.

The Average daily volume (ADV) for the month reached $42.7 billion, 6.9 percent lower compared to $45.8 billion in the previous month. October had 21 trading days, compared to 22 in September.

CLS

CLS’s total average daily traded volume submitted to CLS reached $1.928 trillion, an increase of 3.3 percent compared to October 2021. However, on a month-on-month basis, volumes were down 5.4 percent from September’s $2.04 trillion.

Specifically, FX forward average daily traded volumes were $129 billion for October. This figure decreased by almost 6.5 percent when compared with the previous month. FX swap average daily traded volumes were $1.311 trillion, this figure was down 3.5 percent when compared with the previous month. In addition, spot trades monthly declined 9.8 percent, contributing $488 billion to the total volume.

Euronext FX

The total volume of Euronext’s FX came in at $452,113 million, down 15.1% compared to the prior month’s $532,800 million but up 11.4% compared to $405,785 million in the same period

of last year. The ADV Euronext FX for October was $21,529 million, decreasing 11.1% compared to $24,218 million of September but increasing 11.4% compared to $19,323 million of last October.

FxSpotStream

FxSpotStream had a total volume figure of $1.452 trillion in October, compared with September’s $1.614 trillion. The total figure in the month declined by 10 percent when compared with the previous month, while on a year-on-year basis it increased by more than 37 percent.

The average daily volume (ADV) for October came in $69.1 billion, which is an decrease of 5.8 percent on a monthly basis. On a yearly basis, ADV rose by 37 percent compared to the same period last year.

Moscow Exchange

Moscow Exchange’s average daily volumes was $11.7 billion in October 2022, which represents a decline of 18.7 percent compared to September 2022.

Integral

The customers’ average daily volumes (ADV) across Integral platforms totaled totaled $45.7 billion in October 2022. This represents a decrease of 10.7% compared to September 2022 and a decrease of 9.5% compared to the same period in 2021.