Who acquired IG Group’s US-based regulated binary options business Nadex?

Which up-and-coming institutional FX and crypto company got billionaire Steven A. Cohen’s attention, to the tune of a $14 million investment?

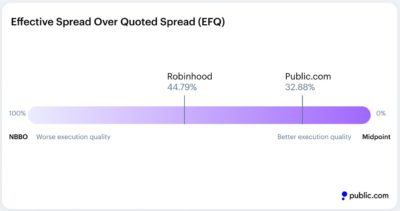

What did social trading focused broker Public.com have to say about how competitor Robinhood’s PFOF client trade execution system was inferior to its model?

What executive changes involves LMAX, Match-Trade, Match-Prime, and Concordium?

Answers to these questions. and a whole lot more, appeared first or exclusively this past week at FNG. Some of the most read and commented-on FX industry news stories to appear over the past seven days on FNG included:

IG Group to sell Nadex and Small Exchange for $216M to Crypto.com. Electronic trading major IG Group Holdings plc (LON:IGG) today announced the proposed sale of North American Derivatives Exchange, Inc. (Nadex) and Small Exchange, Inc, the latter of which the Group owns approximately 39%, to Foris DAX Markets, Inc. The proposed sale is a cash transaction with an approximate, aggregate price for the IG shareholdings in both companies of $216 million. The closing of the transaction is expected to be in the first half of 2022, subject to the satisfaction of customary conditions, including regulatory review. IG says that the deal would not materially impact full-year adjusted operating profit expectations nor the medium-term revenue growth guidance for High Potential Markets previously provided in July 2021.

IG Group to sell Nadex and Small Exchange for $216M to Crypto.com. Electronic trading major IG Group Holdings plc (LON:IGG) today announced the proposed sale of North American Derivatives Exchange, Inc. (Nadex) and Small Exchange, Inc, the latter of which the Group owns approximately 39%, to Foris DAX Markets, Inc. The proposed sale is a cash transaction with an approximate, aggregate price for the IG shareholdings in both companies of $216 million. The closing of the transaction is expected to be in the first half of 2022, subject to the satisfaction of customary conditions, including regulatory review. IG says that the deal would not materially impact full-year adjusted operating profit expectations nor the medium-term revenue growth guidance for High Potential Markets previously provided in July 2021.

Mets owner Steve Cohen invests $14M in 24 Exchange via Point72 Ventures. 24 Exchange, the Bermuda based offshore electronic trading venue founded by former FastMatch CEO Dmitri Galinov, has announced today that it has raised a $14.25 million funding round led by investment firm Point72 Ventures, run by New York Mets billionaire owner Steven A. Cohen. The investment will support the continued expansion of the company’s robust multi-asset trading platform to encompass additional asset classes, including equities and cryptocurrencies. This expansion will also bring new trading options to 24 Exchange’s growing base of institutional market clients.

Mets owner Steve Cohen invests $14M in 24 Exchange via Point72 Ventures. 24 Exchange, the Bermuda based offshore electronic trading venue founded by former FastMatch CEO Dmitri Galinov, has announced today that it has raised a $14.25 million funding round led by investment firm Point72 Ventures, run by New York Mets billionaire owner Steven A. Cohen. The investment will support the continued expansion of the company’s robust multi-asset trading platform to encompass additional asset classes, including equities and cryptocurrencies. This expansion will also bring new trading options to 24 Exchange’s growing base of institutional market clients.

Playtech shareholders approve $250 million Finalto sale. Online gaming and financial services company Playtech plc (LON:PTEC) has announced that its shareholders have voted overwhelmingly in favour of the company’s agreed-upon $250 million sale of its Financials division, Finalto, to Hong Kong based Gopher Investments. Playtech’s financial services division comprises the Finalto-branded institutional services business, and Retail FX/CFDs broker Markets.com. FNG readers will recall that Playtech shareholders resoundingly rejected the previous planned sale of Finalto earlier this year for $210 million. However, that was likely because shareholders expected a significantly better offer for Finalto to emerge, which did eventually happen.

Playtech shareholders approve $250 million Finalto sale. Online gaming and financial services company Playtech plc (LON:PTEC) has announced that its shareholders have voted overwhelmingly in favour of the company’s agreed-upon $250 million sale of its Financials division, Finalto, to Hong Kong based Gopher Investments. Playtech’s financial services division comprises the Finalto-branded institutional services business, and Retail FX/CFDs broker Markets.com. FNG readers will recall that Playtech shareholders resoundingly rejected the previous planned sale of Finalto earlier this year for $210 million. However, that was likely because shareholders expected a significantly better offer for Finalto to emerge, which did eventually happen.

Public.com attacks Robinhood and PFOF brokers with trade execution data. Social trading brokerage startup Public.com, in the news recently for engaging supermodel brand ambassadors, sports all-stars, and adding crypto trading, has issued a fairly interesting take on payment-for-order-flow, or PFOF. PFOF – which Public.com eschews – is a method by which most of Public.com’s competitors such as Robinhood make money, i.e. offering commission-free trades by selling customer order flow to institutional market makers. Used by numerous US retail brokers but basically banned in Europe and Australia, there has been much debate in the online trading industry as to whether or not PFOF has been a net positive or negative for retail clients.

Public.com attacks Robinhood and PFOF brokers with trade execution data. Social trading brokerage startup Public.com, in the news recently for engaging supermodel brand ambassadors, sports all-stars, and adding crypto trading, has issued a fairly interesting take on payment-for-order-flow, or PFOF. PFOF – which Public.com eschews – is a method by which most of Public.com’s competitors such as Robinhood make money, i.e. offering commission-free trades by selling customer order flow to institutional market makers. Used by numerous US retail brokers but basically banned in Europe and Australia, there has been much debate in the online trading industry as to whether or not PFOF has been a net positive or negative for retail clients.

Top FX industry executive moves reported at FNG this week included:

Przemyslaw Wojtyna

Customize your hero and embark on a thrilling quest! Lucky cola

Özellikle öğrenci ve olgun escort kategorilerinde oldukça geniş bir portföy sunuyorlar. Çankaya’da tercih edilecek tek adres.

Ankara’da hem yerli hem yabancı model seçenekleriyle böyle bir siteye denk gelmek nadir. Ankara escort pazarında bir numara.

Hem web tasarımı hem kullanıcı deneyimi açısından site çok iyi. Ankara escort hizmetleri bu kadar profesyonel verilmemişti.

Explore the ranked best online casinos of 2025. Compare bonuses, game selections, and trustworthiness of top platforms for secure and rewarding gameplaycasino bonus.