Online trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has just posted its key performance metrics for November 2021.

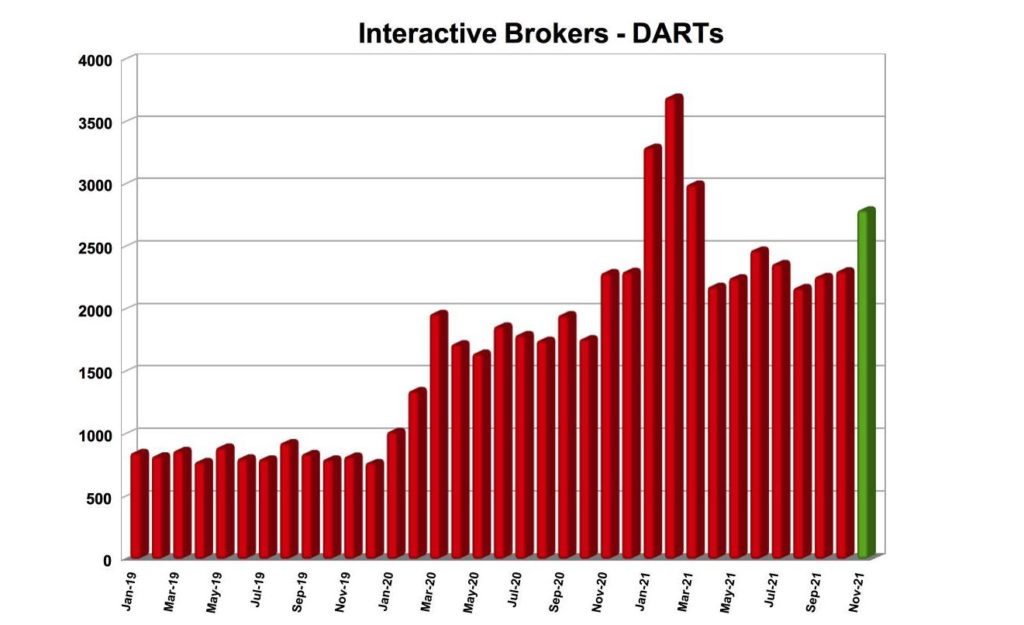

The broker reported 2.793 million Daily Average Revenue Trades (DARTs) for November 2021. The result is 22% higher than in November 2020 and 21% higher than the 2.305 million Daily Average Revenue Trades registered in October 2021.

The broker posted 387 annualized average cleared DARTs per client account.

The number of client accounts also rose. The company registered 1.64 million client accounts, 58% higher than prior year and 3% higher than prior month.

Average commission per cleared Commissionable Order was $2.27 including exchange, clearing and regulatory fees.

Speaking of Interactive Brokers’ performance, let’s note that the broker reported diluted earnings per share of $0.43 for the third quarter of 2021 compared to $0.58 for the equivalent period in 2020, and adjusted diluted earnings per share of $0.78 for this quarter compared to $0.53 for the year-ago quarter.

Net revenues were $464 million in the third quarter of 2021, down from $548 million a year earlier.

Income before income taxes was $234 million for the third quarter of 2021, compared to $334 million for the same period in 2020.

Commission revenue increased $32 million, or 11%, from the year-ago quarter on the back of higher customer stock and options trading volumes.

Net interest income increased $79 million, or 41%, from the year-ago quarter thanks to higher margin loan balances and strong securities lending activity.

Good day! Do you know if they make any plugins to assist with Search Engine

Optimization? I’m trying to get my website to rank for some targeted keywords

but I’m not seeing very good success. If you know of any please share.

Thanks! You can read similar blog here: Bij nl

Hello there! Do you know if they make any plugins to help with SEO?

I’m trying to get my site to rank for some targeted keywords but I’m not seeing

very good results. If you know of any please share. Appreciate it!

You can read similar art here: Change your life

I’m extremely inspired with your writing skills and also with the structure for your weblog. Is that this a paid subject or did you customize it your self? Anyway stay up the nice high quality writing, it is uncommon to peer a nice blog like this one nowadays. I like yiwu2050.com ! I made: Affilionaire.org

I am really impressed with your writing skills as smartly as with the layout for your weblog. Is this a paid topic or did you customize it yourself? Anyway stay up the nice high quality writing, it’s uncommon to peer a great weblog like this one today. I like yiwu2050.com ! It’s my: Lemlist

Çankaya’da gerçek bir deneyim yaşamak istiyorsanız bu siteyi mutlaka değerlendirin. Her profilde özen ve profesyonellik var.

Çankaya’da bir süredir aradığım kaliteli ve güvenilir deneyimi nihayet bu sitede buldum. Çankaya escort arayanlara kesinlikle tavsiye ediyorum.

Günümüzde kaliteli hizmet bulmak zor. Ancak AnkaraRusModel bu konuda fark yaratıyor. Özellikle Çankaya escort kısmı şahane.

Yabancı modeller ve yerli escort seçenekleriyle mükemmel bir deneyim sunuyorlar.

Hem fiyat hem hizmet kalitesi açısından Çankaya Escort konusunda açık ara öndeler. İyi ki burayı tercih ettim.

File Bandajlar kategorisinden alışveriş yaptım. File Bandajlar ürünleri kaliteli, hızlı kargolu ve kullanışlı. Tavsiye ederim.

Solunum Destek Ürünleri kategorisinden alışveriş yaptım. Solunum Destek Ürünleri ürünleri kaliteli, hızlı kargolu ve kullanışlı. Tavsiye ederim.